Empire rebuilding

91-year-old media mogul Rupert Murdoch is eyeing a reunion of his major assets, exploring the remerging of Fox Corp. and News Corp. almost a decade after splitting them up back in 2013.

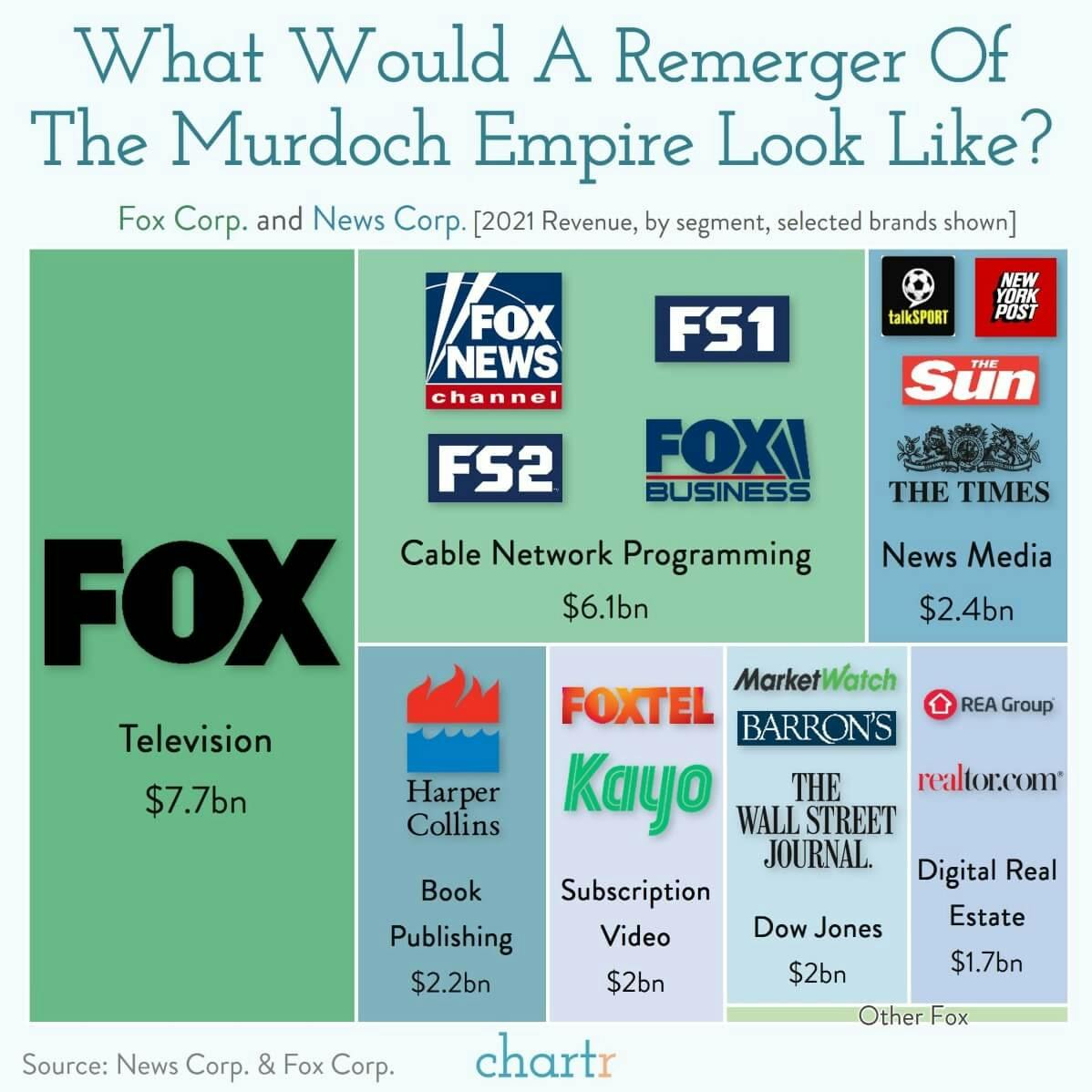

Thought to be a precursor to a smooth succession, a combination of the two companies would put a number of influential assets under the same corporate umbrella. Through a family trust, Murdoch controls 39% and 42% of the voting stock in News and Fox Corp., respectively, giving him substantial control over the operations of both companies. But after a number of transactions over the last two decades, what's left in the Murdoch empire?

Media mass

Fox Corp. currently houses most of the TV & cable assets that weren’t sold to Disney back in 2019. The Fox Network, combined with cable programming like Fox Business, Sports and News, brought in nearly $14bn in revenue last year.

News Corp., meanwhile, is a broader church. It encompasses digital real estate assets such as the REA Group and Realtor.com, book publishers Harper Collins, and news outlets across the world like the WSJ, Barrons, MarketWatch, The New York Post, The Times and more.

Separated, the two are already mega companies. News Corp.’s market cap is currently just shy of $10bn and Fox Corp.’s is $15.7bn. Together, so the theory goes, they would be a bigger entity with more financial power to take on competitors — an appealing proposition for whichever heir succeeds Murdoch Snr.