Stellantis to lay off hundreds in US, pause work at plants in Mexico and Canada because of tariffs

The layoffs and production pauses are so far being billed as temporary. Canada also announced retaliatory 25% tariffs on American-made vehicles.

In response to President Trump’s 25% tariffs on imported vehicles, Jeep maker Stellantis on Thursday said it’s laying off 900 US workers across five facilities and temporarily pausing production at two assembly plants in Canada and Mexico.

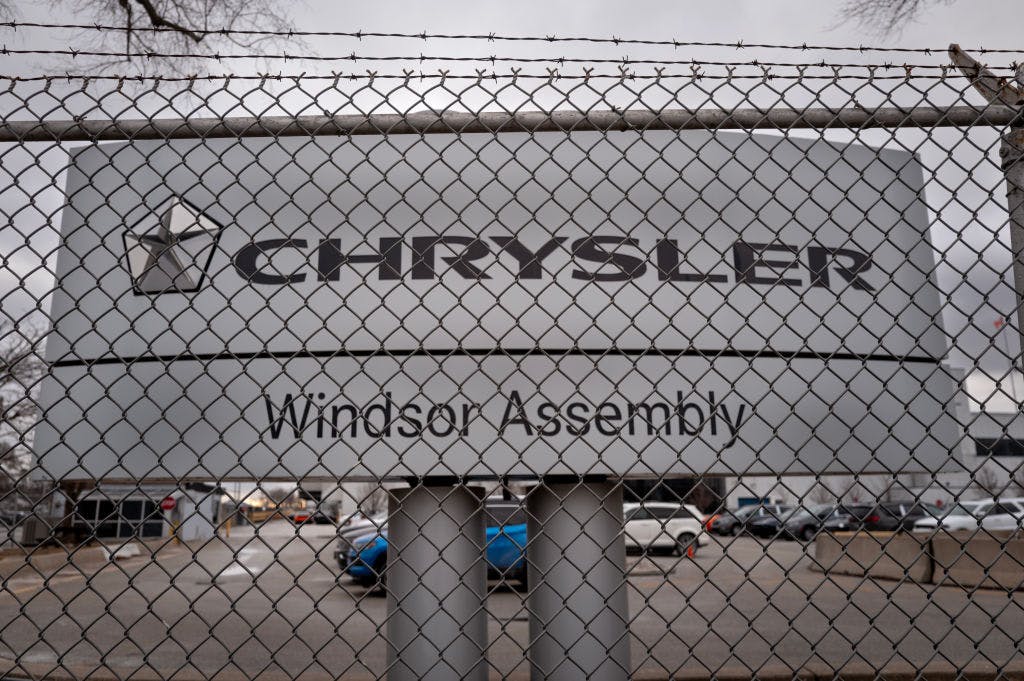

The Windsor, Canada, plant (which produces the Chrysler Pacifica minivan) will shutter for two weeks — affecting 4,500 Canadian workers. The Toluca, Mexico, plant (which produces the Jeep Compass SUV and the Wagoneer S) will be closed through the end of April, though employees there will reportedly still go to work and be paid.

Likely adding to the pain seen in Stellantis’ share price, Canada on Thursday announced retaliatory 25% tariffs on American-made vehicles. Prime Minister Mark Carney announced the reciprocal levies, which mirror the structure of those issued by Trump. In other words, vehicles compliant with the USMCA are exempt.

This week, Stellantis reported that its US sales fell 12% in the first quarter from the same period last year. That figure runs counter to its Detroit rivals Ford and GM, which have seen sales surge in anticipation of Thursday’s auto tariffs. GM’s Q1 sales rose 17%, while Ford’s March sales rose 19% (its overall Q1 sales fell 1%).