Strategy kicks off the week with $110 million bitcoin buy

Two new companies also entered the bitcoin buying trend.

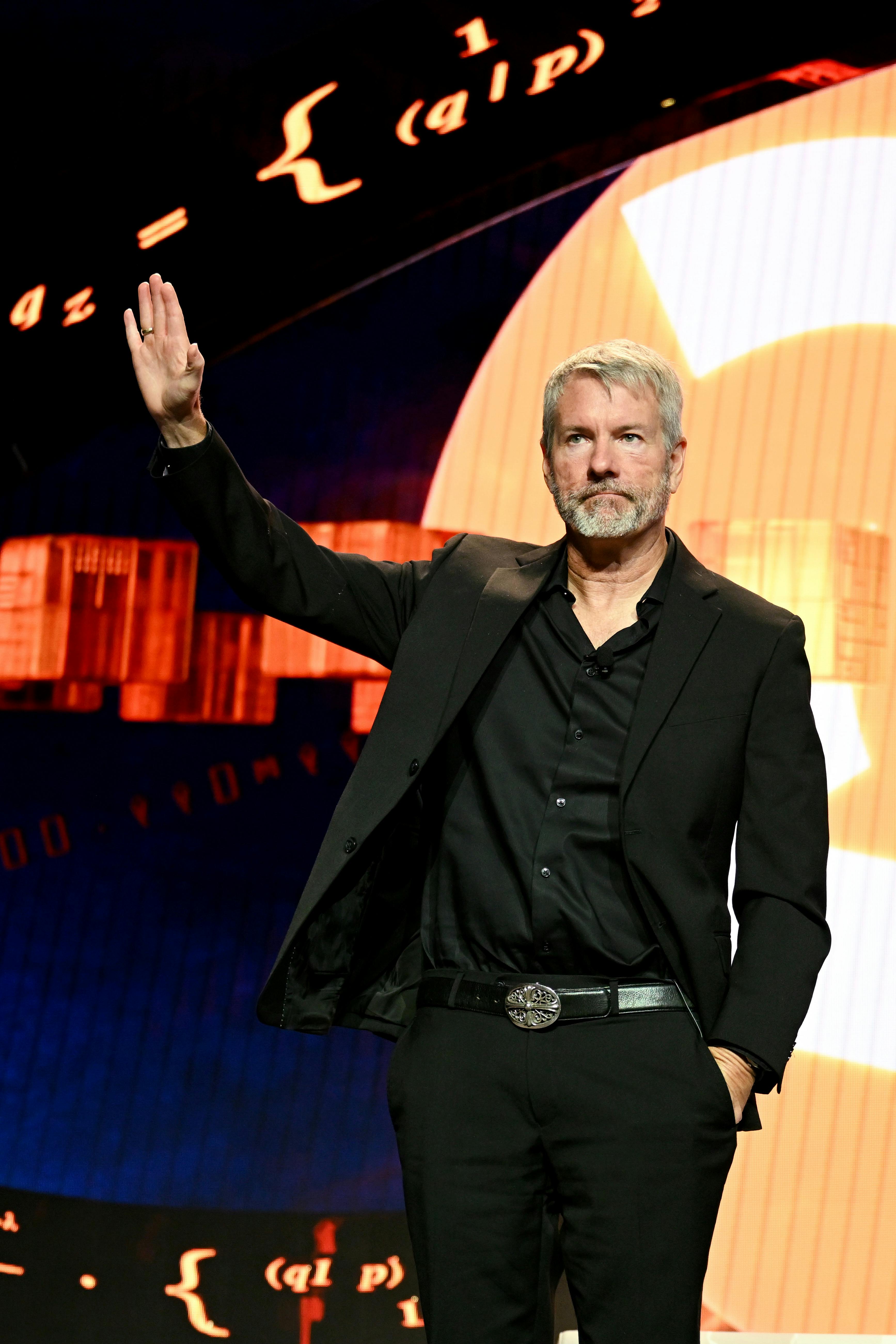

This morning, Strategy cofounder Michael Saylor posted that the company acquired 1,045 bitcoin for $110.2 million and now holds 582,000 bitcoin. Strategy was up 1.5% in early trading.

Meanwhile, bitcoin saw a rebound over the weekend, trading in the $107,500 range this morning. The corporate bitcoin buying spree also added two newcomers to the fray.

French company The Blockchain Group announced it was raising €300 million ($342.2 million) via an at-the-market program to buy more bitcoin. The company holds 1,471 bitcoin.

The program “is largely inspired by the U.S. practice of at-the-market programs,” the company said in a press release, adding that the goal is to “accelerate its bitcoin treasury strategy.” ATMs have been one approach Strategy has used accumulate bitcoin.

SilverBox Corp IV, a publicly listed SPAC, announced it has entered into a nonbinding letter of intent with Parataxis Holdings to “bring bitcoin-native capital platform to public markets,” according to a press release.