What if global trading weren’t tied to the working hours of bankers in New York?

A radical plan wants to make trading anything faster and settled instantly. Can tokenization get off the ground?

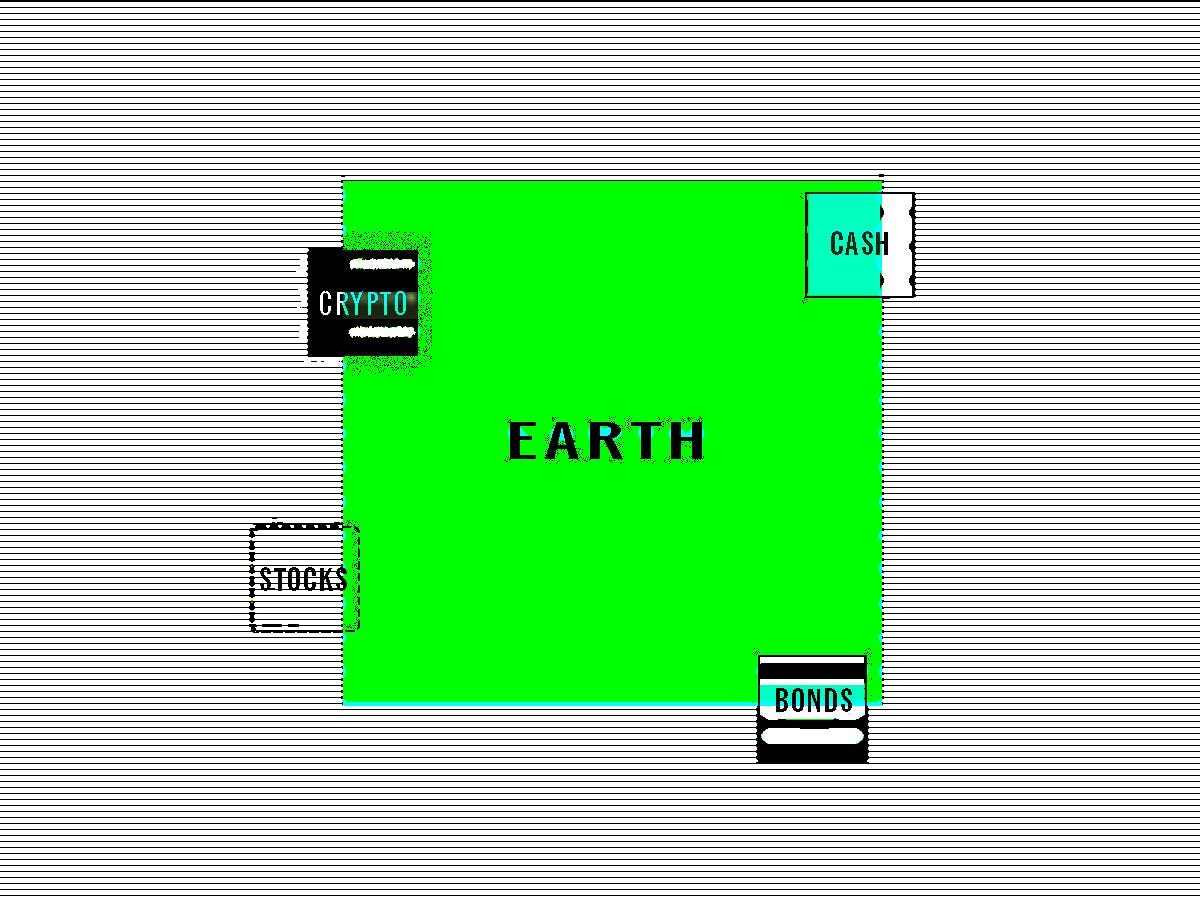

Picture a more global financial system in which all stocks, bonds, and commodities are made into tokens — digital assets that represent value or ownership in a decentralized system. These digital twins can be tracked on a unified digital ledger, with automated back-office processes. The system could run 24/7, every day of the year, and all transactions are completed in real time.

It’s not exactly a vision of flying cars and sentient robots, but it’s a seismic shift for the financial industry all the same, a future where crypto and traditional finance would converge to unlock, per analysts’ projections, a multitrillion-dollar market of tokenized securities.

There are several ways tokenization can figure into financial services, but it found a natural fit as an upgraded investment wrapper. Just as ETFs are thought of as the 2.0 version of mutual funds, with their transparency and ability to trade intraday, tokens, which are compatible with souped-up decentralized finance (DeFi) platforms, are emerging as a new 3.0 product.

Indeed, Bitcoin ETFs have driven renewed interest in the subject, as the finance-y side of crypto basks in the glow of bitcoin ETFs’ success. Launched in January, these ETFs crossed a new high of over $1.4 billion in inflows following Donald Trump’s reelection last week.

“WisdomTree’s journey started with the belief that ETFs are a superior technology to mutual funds. We asked ourselves, ‘What will it be next?’” the company’s head of digital assets, Will Peck, told Sherwood News. “And that’s how we came to tokenization of real-world assets.”

WisdomTree has over a dozen tokenized investment funds, as well as business- and investor-facing apps whose features offer a glimpse of what tokenization can do. For example, app users can spend directly from their tokenized funds via a debit card. (Other big money managers have a similar feature sans blockchain.)

“Think about what things could look like if investments are connected more closely to payments, or you might like the idea of being able to move assets and value around more seamlessly,” Peck said. Tokenization allows anyone “the ability to be able to access your money exactly when you want it and get finality on that transaction.”

Cash management is one corner of growing interest. With a higher federal funds rate, there was rising demand for an on-chain yield-bearing fund for crypto natives.

“One of the things they tell us consistently is that it’s very important for them to be able to interact on-chain,” Peck said of WisdomTree’s customers. “But they want it to feel like it does in crypto right now, which is that they can settle instantly.”

That type of product has drawn asset managers into the mix in the past year, with companies like BlackRock and Janus Henderson partnering up with crypto shops to tokenize US Treasury funds.

The promise and the peril of tokenization

Tokenization is an attractive proposition to asset managers at large because it opens up investment products that were previously reserved for the well-heeled to anyone.

Rolling out fractional trading could make more of those products accessible to the masses. Think initial public offerings, private credit, hedge funds. “Maybe that would make the financial system a bit fairer,” Lucas Vogelsang, cofounder of tokenization platform Centrifuge, said.

Greater accessibility, faster settlement, more transparency, and lower operational costs are all potential benefits of tokenization, per a Deloitte study published in April. It also outlined possible consequences: “more rapid onset of financial crises” as well as “faster execution of financial frauds” and “smaller windows of opportunity to make monetary policy decisions.”

Regulators and policymakers also worry about the knock-on effects of tokenizing everything.

“Tokenization of assets may have the potential to improve efficiencies and provide access to new markets for investors, but it can also amplify many of the same vulnerabilities in traditional finance,” Klaas Knot, chair of the Financial Stability Board, wrote in an October letter addressing G20 finance ministers and central-bank governors.

Those concerns apply to tokenization at scale, which crypto industry experts anticipate is a two-decade story in the making. “At some point, the technology will reach maturity and large financial institutions will actually rip out their back end and put in DeFi, but that will take years to truly happen,” Vogelsang said.

Where we are now: baby steps and experimentation

One of the limitations of tokenized funds now is their mullet-like structure: token on the front, legacy systems in the back. A token trades 24/7, but its underlying assets are tied to traditional finance operations.

For example, Superstate, a company founded by Robert Leshner, better known as the creator of DeFi lending application Compound, focuses on tokenizing traditional financial assets. Investors who bought into one of the company’s tokenized funds would have to wait until the next full business day to see their tokens accrue to their wallets, Leshner explained.

To understand why that’s true, remember: when an investor buys or sells a security like a mutual fund, the transaction is executed, but finalized only after settlement. That process refers to the transfer of the product and associated cash.

In the US, the Securities and Exchange Commission sets the standard of T+1, or one business day. In the days of yore, settlement could take as long as five days, because trading then meant hand-delivering stock certificates.

So far, Superstate has a short-term government-debt fund as well as a cash-and-carry fund, which aims to generate a return by exploiting the price difference between digital assets and corresponding derivatives.

The firm recently rolled out continuous pricing for the firm’s Short Duration US Government Securities Fund (USTB), which would enable near-instant transfers between USTB and stablecoin USDC.

“What we’re getting at is the ability to prove that tokenized assets are able to absorb all the best properties of crypto assets — that is, they’re extremely transferable, efficient, and programmable.” he said. “This is an incremental step towards something great, with the back end of a product and token in lockstep.”

Plus, speeding things up doesn’t necessarily lead to more risk. Take sending someone a letter via email versus snail mail as an example. “This is really more an abstract thought, but the faster information moves, the more efficient society can be,” Leshner said. “By shortening the time for financial transactions to exist in a state of uncertainty, society can make better decisions.”

Critics ask, is this really crypto or just fintech?

Some in crypto aren’t keen on the premise of tokenization.

“Taking a pile of dog shit, putting a wrapper around it, and putting it on-chain does not make it a better asset,” Meltem Demirors, founder of investment firm Crucible, said in a panel at a tokenization conference in New York last month.

Tokenizing real estate didn’t make it more liquid, nor more desirable. There were dozens of projects and deals that came to market five years ago but failed because they ran into technical issues, or legal ones. Chalk it up to the nascency of the market, the mismatch between the technical and the bureaucratic, or bad deals trying to gin up interest with buzzy tech. Whatever it was, few, if any, were buying.

Demirors also took issue with the money flow in tokenization: “Today, there are about $200 billion in stablecoins. What are we doing? We are taking money out of the crypto ecosystem.”

She added: “Taking $50 billion of bitcoin out of circulation and giving it to a financial institution that charges between 20 and 250 basis points for the privilege of holding it for you is not crypto innovation. That is financial innovation. That is asset-management innovation.”

To her point, financial firms are not evangelizing crypto via tokenization, WisdomTree’s Peck said. The idea of tokenization was initially seen as a wholesale move from one investment wrapper to the next in what Peck calls “replatforming”; now it’s thought of as another channel to reach a different crowd.

“I still believe tokenization is going to be the future of asset management,” Peck said. “I just think the path to get there might be different than how we previously thought about it.”

By the time tokenization makes it to prime time, the tech and how it’s implemented may not matter to end users. It’ll just be how investors — whether or not they are crypto fans — trade and move their money.

Crystal Kim is a New York-based reporter. She has covered crypto, markets, and investing for Barron's, Bloomberg, and Axios.