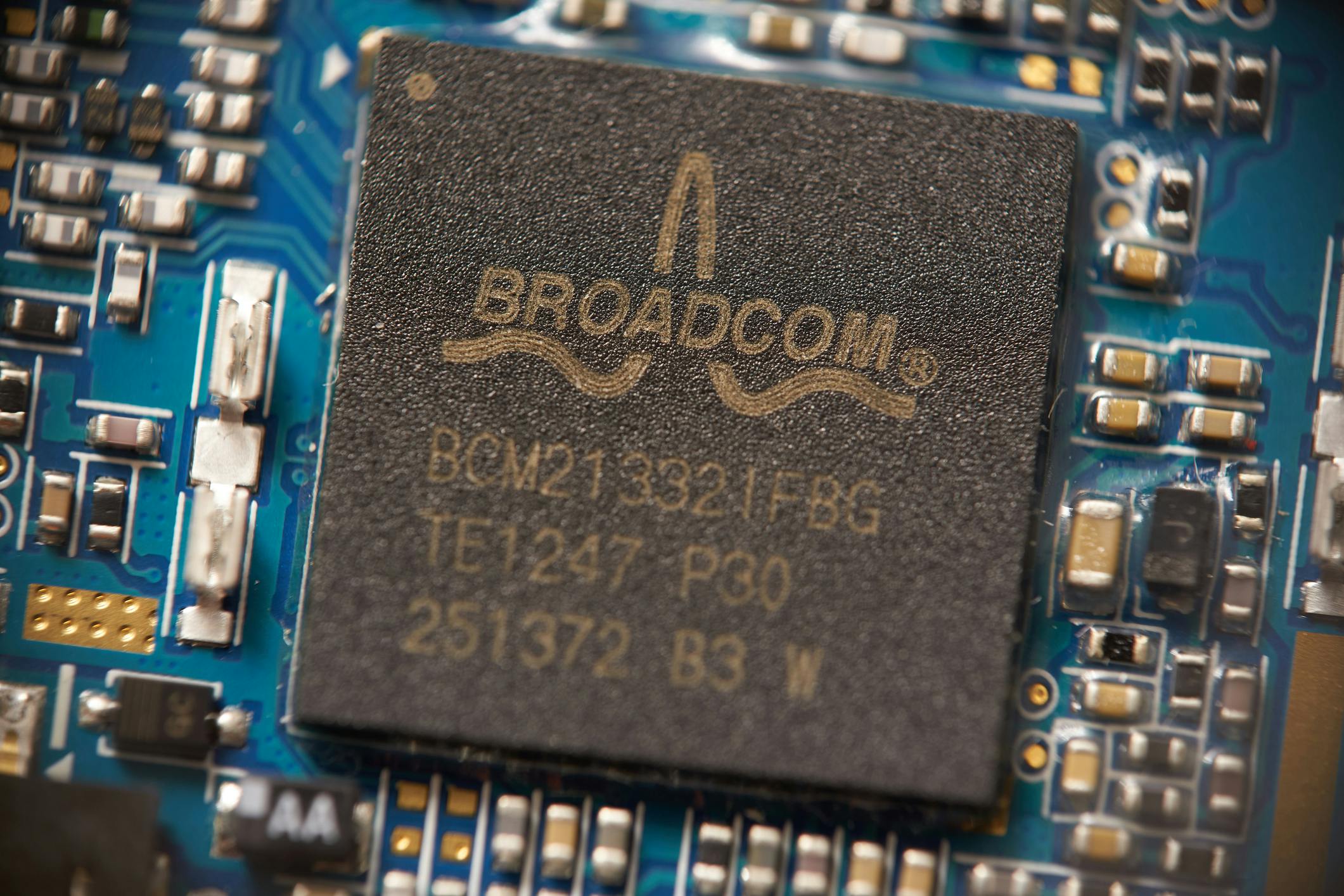

Broadcom builds on massive gains with more massive gains

Growth in its AI business sees Broadcom take the baton of market leadership in semiconductors.

Semi stalwart Broadcom is extending the post-earnings surge that sent the stock into the trillion-dollar-market-cap club with another double-digit advance on Monday.

The company’s value has swelled by more than $300 billion over the past two sessions. To put that in perspective, if the market cap added by Broadcom since reporting earnings were a standalone company, it’d be the 25th biggest company in the S&P 500.

Once again, Broadcom’s gain is seemingly Nvidia’s pain, with investors judging that the progress in its AI business may ultimately be coming at the expense of its larger peer. The $3 trillion chip designer is down about 2% on Monday, while the VanEck Semiconductor ETF is up about 2% as of 2:20 p.m. ET. This is the first time since May 2022 — that is, well before the AI boom began — that the exchange-traded fund that tracks major chip stocks has gained during two weeks in which Nvidia has fallen by more than 5%.