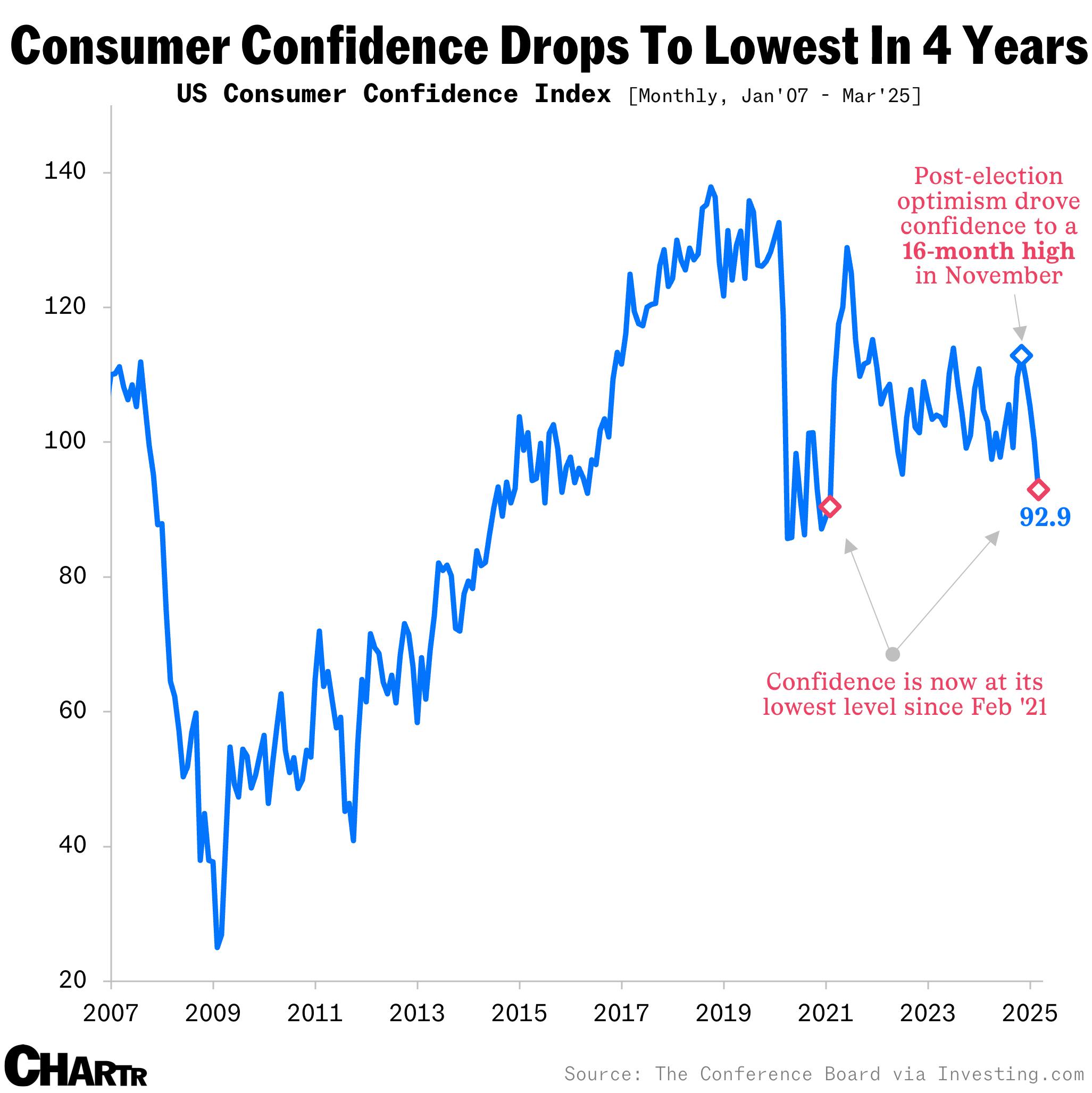

Consumer confidence falls sharply

With prices still high, tariffs looming, and stocks taking a hit, sentiment has slid to its lowest since 2021.

American consumers aren’t feeling so good.

The US Consumer Confidence Index, which measures how optimistic (or not) people feel about the economy, fell to 92.9 in March — its lowest level since February 2021. It also marks the fourth straight monthly decline since postelection euphoria in November.

Expectations on income, business, and job market conditions over the next six months also fell to 65.2, a 12-year low and well below the 80-point threshold that often signals a recession.

According to the Conference Board, inflation still remains a major concern, with prices for household staples like eggs and trade policy uncertainties weighing on consumers. New tariffs could push costs higher, and major retailers are already seeing signs of strain — from smaller pack-size purchases to softer-than-expected sales, CNBC reported.

The share of respondents saying they expected stock prices to rise over the next 12 months also dropped, from 46.7% in February to 37.4% in March.

The confidence dip is the latest sign of growing household stress: in February, the share of Americans confident they could cover a $2,000 emergency expense fell to a record low.