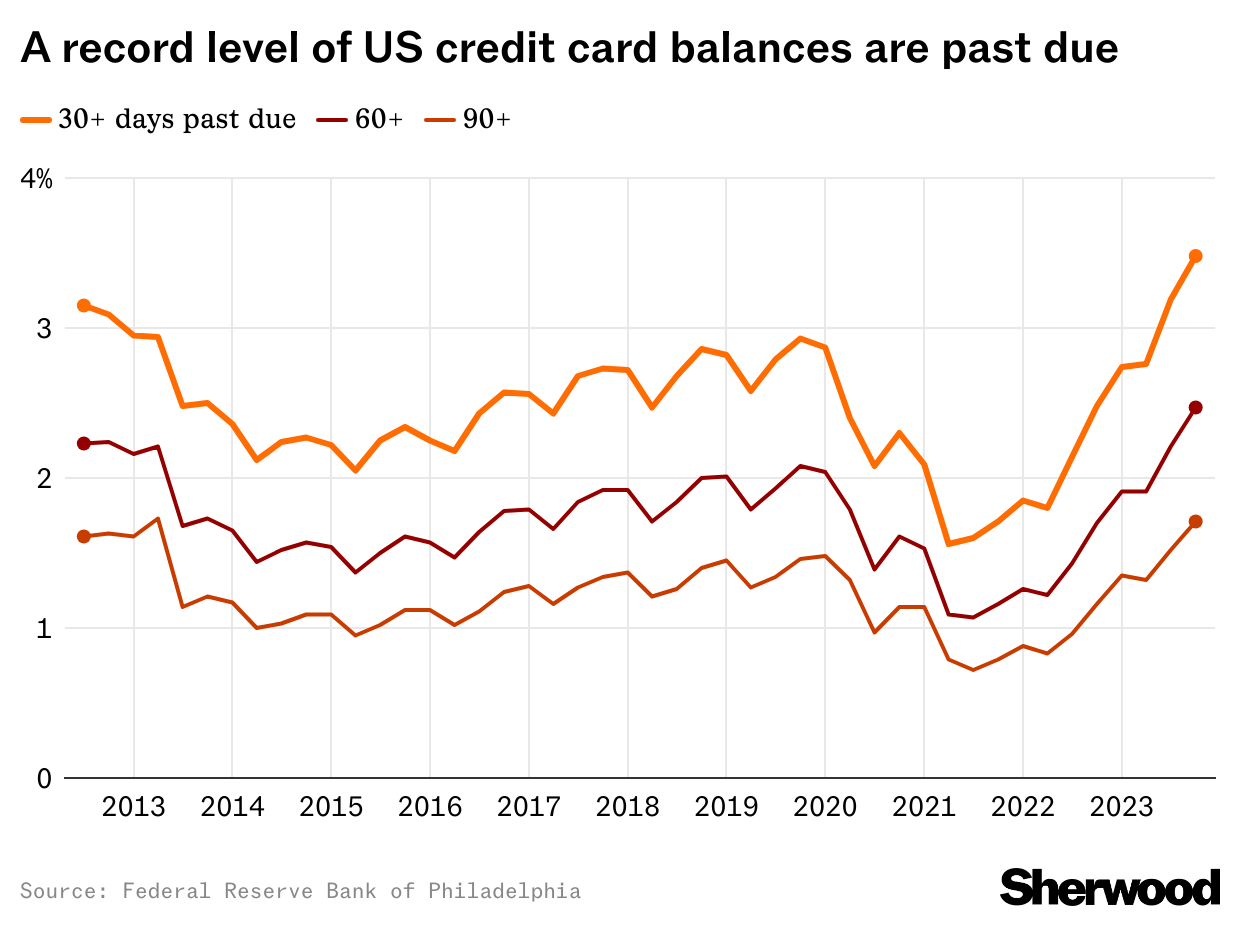

Credit card delinquency is at the highest rate on record

A record 3.5% of US credit card balances were more than 30 days past due at the end of last year, according to data released yesterday by the Federal Reserve Bank of Philadelphia, whose data goes back to 2012.

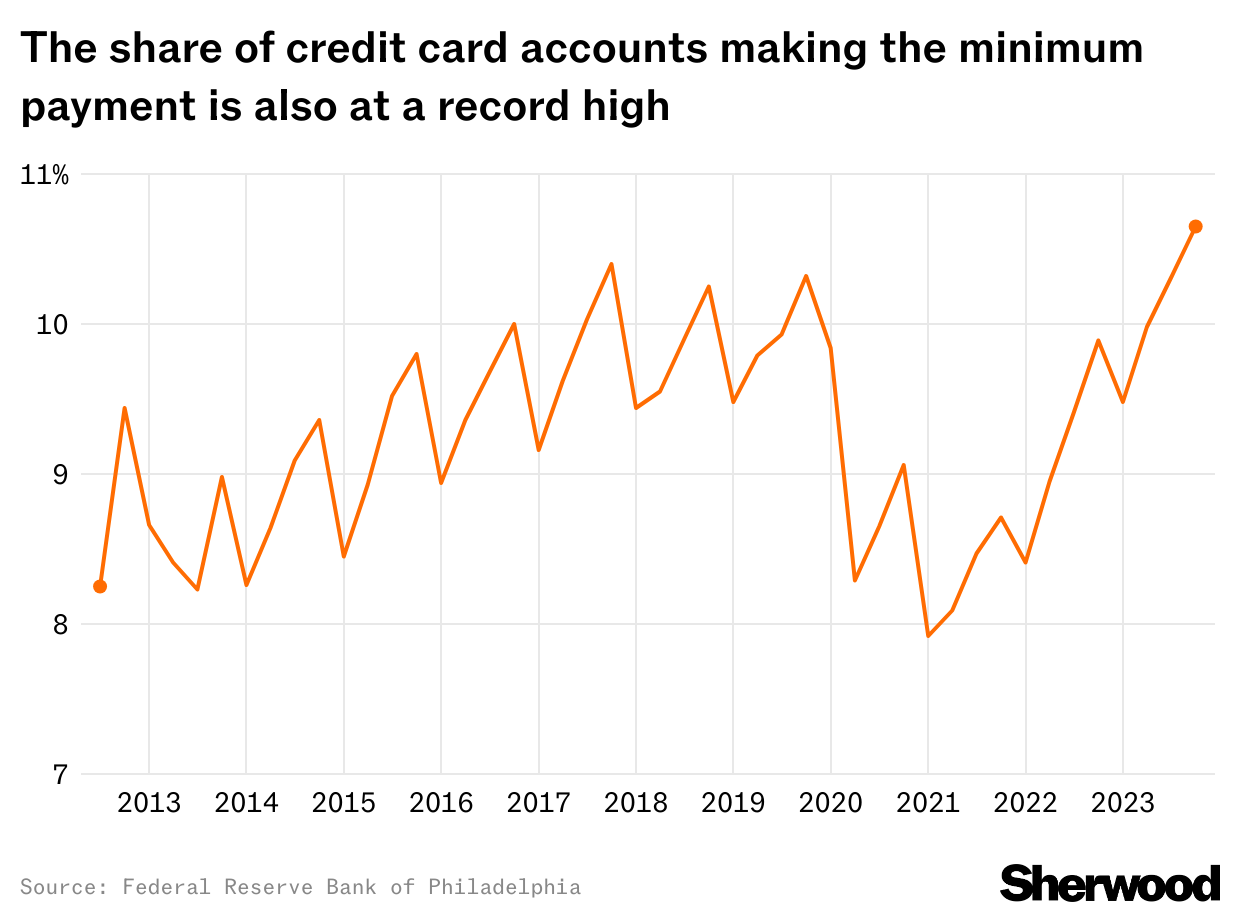

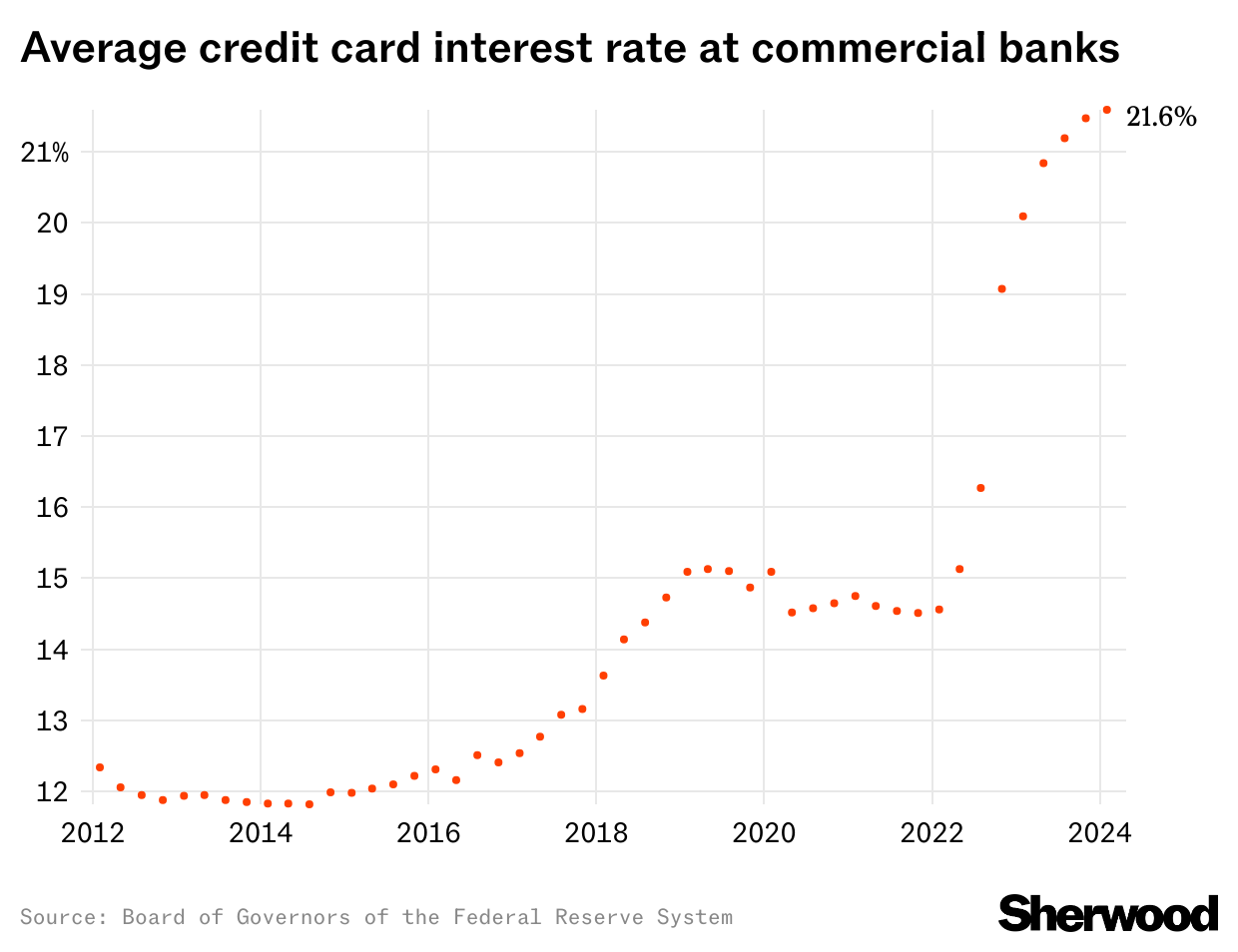

Additionally, a series high of nearly 11% of account holders made just the minimum payment, as consumers struggle with inflation and the higher costs of living it brings. That’s not going to get any easier, since they also have to deal with record credit card interest rates — 21.6% on average from commercial banks — as well.