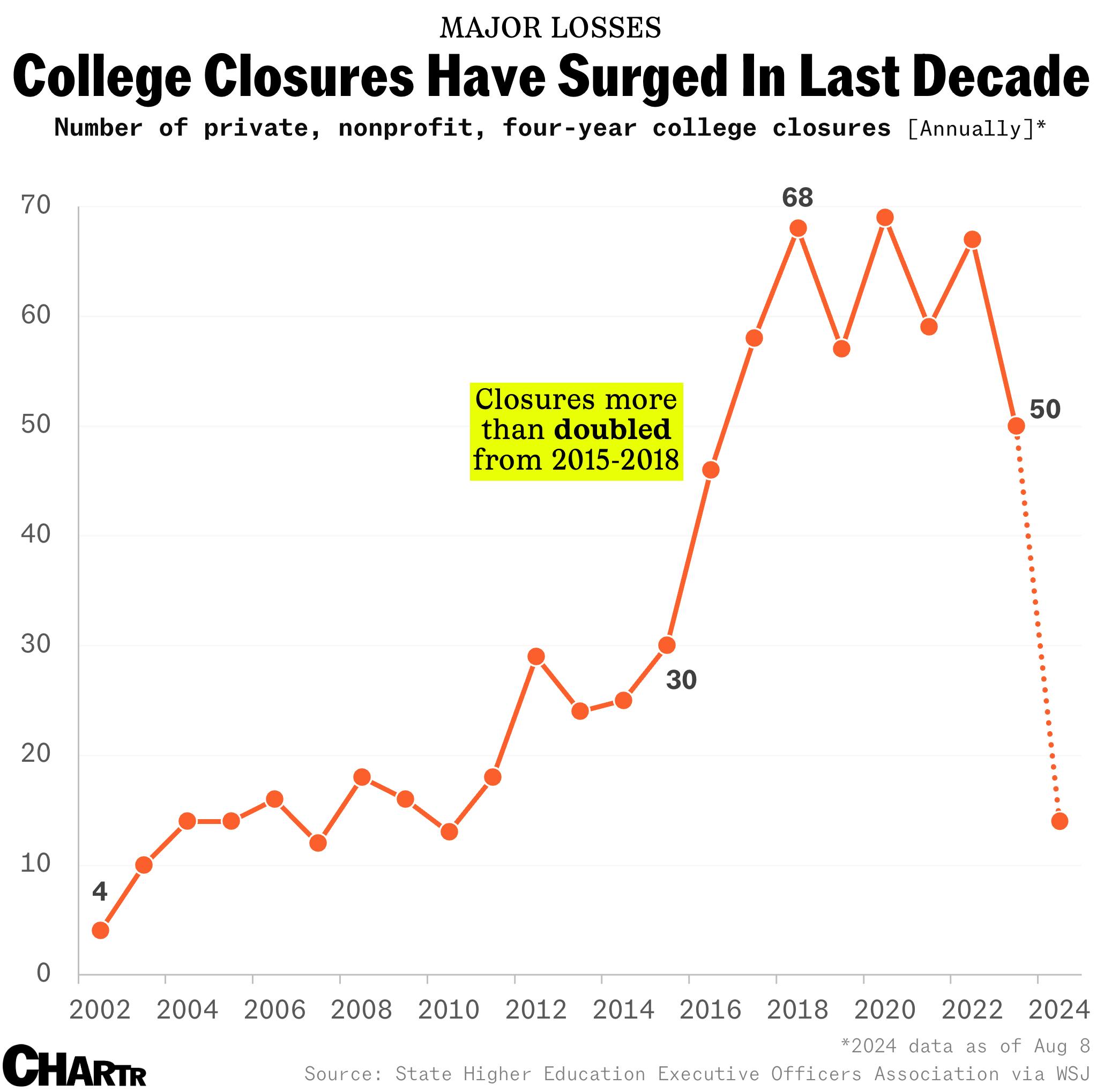

College closures in the US have risen sharply in the last 8 years

More than 500 private four-year universities have closed in the last 10 years alone

It’s an uncertain time to be a student in the US.

With sky-high tuition fees, a continued wave of university president resignations, and the effects of mass protests at the start of the summer now calcifying into harder restrictions on campuses, undergraduates are also facing sudden college closures that threaten the completion of their degrees altogether.

Indeed, a new report from the Wall Street Journal outlined a surge in traditional colleges shutting down across America. From 2014 to 2023, some 529 private, non-profit four-year institutions have shut down — 3x as many as in the previous decade — including renowned establishments like New York’s 156-year-old Wells College closing their doors.

Degrees of separation

While several factors are at play, the major driving force is simply the strain from tuition losses, as the number of people going to college continues to dwindle. According to the National Center for Education Statistics, enrollment in postsecondary institutions was down 12% in 2022 from its recent 2010 peak.

That’s partly due to longer-term demographic trends (America’s birthrate has been dropping for decades), but also because prospective students are doing napkin math and thinking: maybe the cost of a 4-year college degree just isn’t worth it.

Indeed, despite a number of measures to assuage student debt, which have waived more than $168 billion in loans for ~4.8 million eligible Americans since 2022, the cost of college remains formidable for many. A Pew Research Center poll published in May found that only 22% of American adults said that the cost of getting a college degree was worth it if someone has to take out loans; 47% said it was worth it only if you don’t need a loan, and 29% said it wasn’t worth it at all.