BYD time

For Chinese manufacturing giant BYD, it seems like the only way is up at the moment — the automaker has just posted its third consecutive month of record-breaking EV sales and climbed 224 positions on this year’s Fortune Global 500.

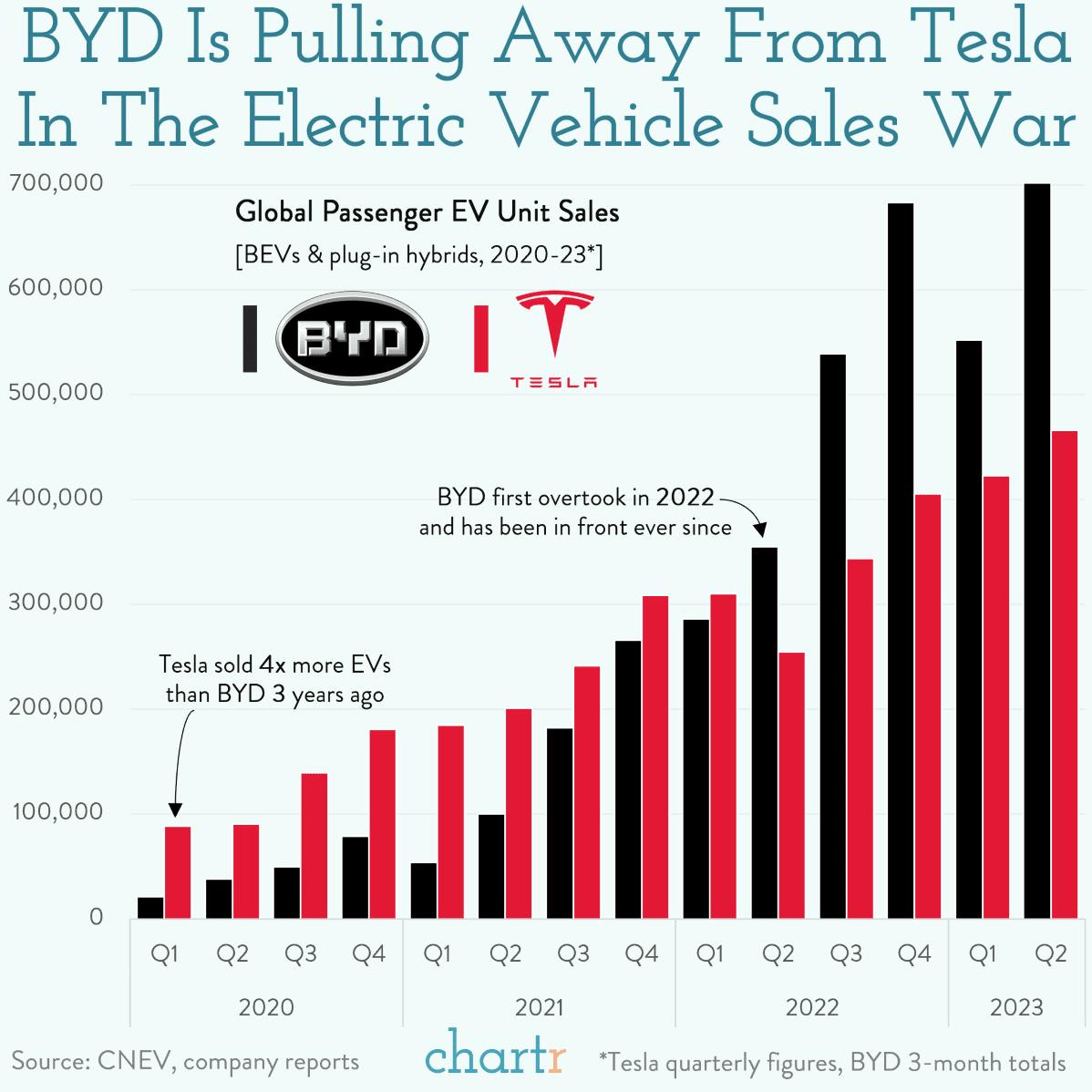

While its 212th placement on Fortune’s list will undoubtedly be the first time that some in the West will have come across BYD, the company has quietly become one of the two major players in the electric vehicle game and is pulling away from its more brazen US counterpart, Tesla.

Supercharged growth

BYD’s growth in recent years has seen the company overtake huge brands at both national and international levels — in May, we charted the company’s 2-year journey from being China’s 5th biggest automaker to the top spot with a 10.4% market share. Although comparisons with Tesla aren’t exact — Musk’s company deals exclusively in battery electric vehicles (BEVs), while BYD makes plug-in hybrids too — a similarly speedy ascent has played out in the global EV market.

In 2020, Tesla finished the year with just under 500,000 deliveries, more than double BYD’s figure of ~188,000, but, just 2 years later, the tables had firmly turned. By the end of 2022, the Chinese automaker saw its net income soar 446% as it cemented its position at the top of the EV market, selling nearly 1.9 million models compared to Tesla’s 1.3 million tally.