Control Alt delete: Exploring OpenAI's corporate structure, after Sam Altman’s shock dismissal

Control Alt delete

It’s been a chaotic few days for OpenAI, the artificial intelligence giant behind ChatGPT.

In the ~72 hours since our Friday send, co-founder and CEO Sam Altman was shock-fired by the board; a host of high-profile resignations were tendered; chief technology officer Mira Murati was appointed as interim CEO; momentum to reinstate Altman gathered steam; the board reportedly agreed to reverse the decision in principle; negotiations faltered, however, and Emmett Shear — a cofounder of video streaming platform Twitch — is the new interim CEO, with Altman taking a role at Microsoft.

And, in the latest twist, 505 out of ~700 OpenAI employees have signed a letter threatening to quit unless the board resigns and Altman is reinstated.

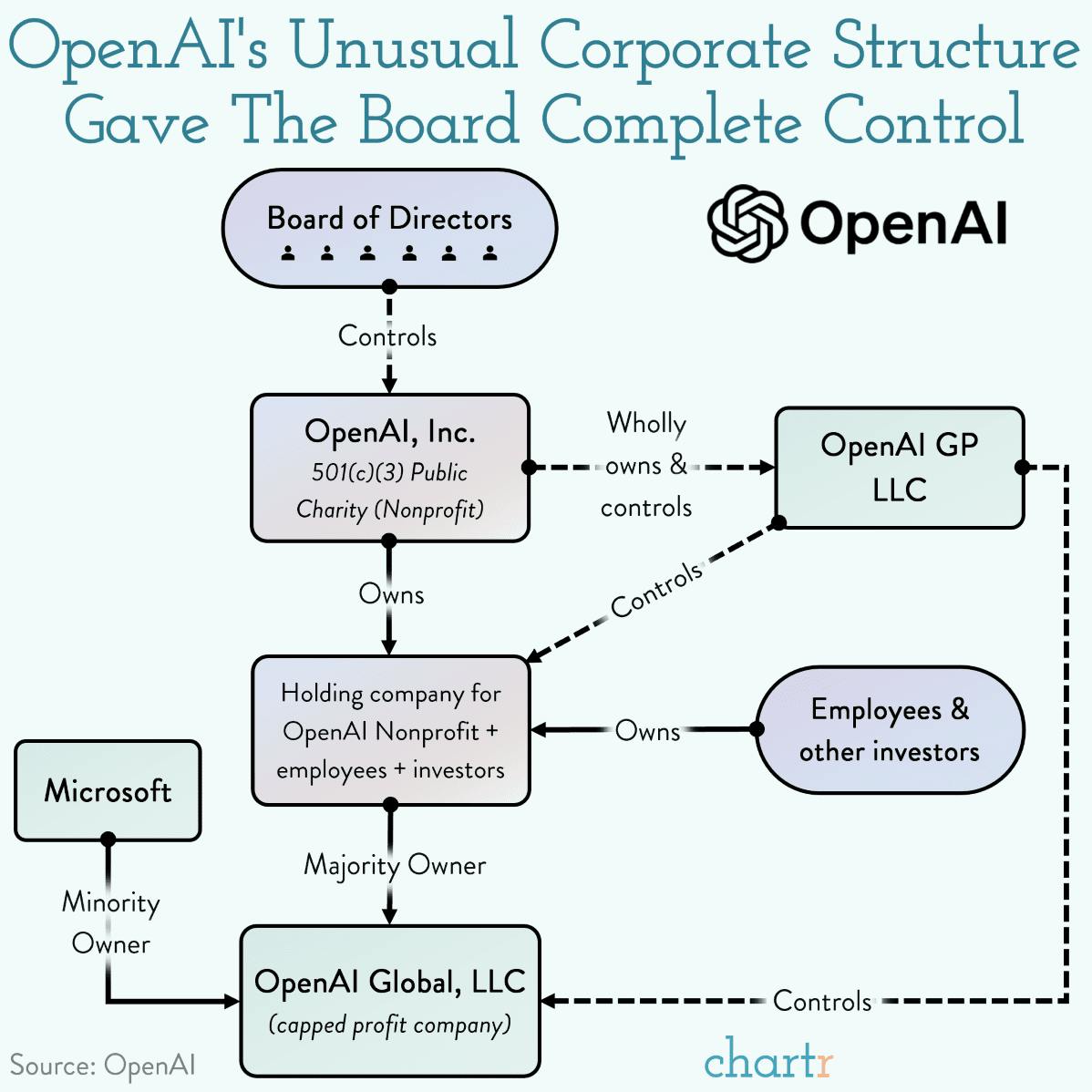

How a generationally-important company like OpenAI could be plunged into such chaos is partly down to its unique corporate model. Following the company's structure from top to bottom — even with a few subsidiaries thrown in — reveals that the board of directors had ultimate control to make decisions over both the nonprofit and for-profit OpenAI entities... leaving anchor investor Microsoft blindsided by Altman’s exit just moments before the public announcement.

The company that launched ChatGPT less than a year ago claims that its structure is designed to develop artificial general intelligence that’s “safe and benefits all of humanity”, with the capped profit arm of OpenAI, first introduced in 2019, able to issue equity and raise capital to further the work of the original nonprofit that was established in 2015.

Move slow and make things

New CEO Emmett Shear has made a name for himself in the AI world by advocating for industry slowdowns in the name of safeguarding, making him an appealing Altman alternative for the board at OpenAI — even as dozens of OpenAI employees and key board members take to X (formerly Twitter) to show their support for Altman.

Related reading: See all of our charts on ChatGPT.