TikTok bites back against ban

The Chinese owner of the social media app starts its appeal against a US-wide ban today

This morning, a US federal appeals court will hear the case for keeping TikTok — almost 5 months after the Senate voted overwhelmingly in favor of legislation which, at present, will see the popular social media app face a total nationwide ban if Chinese parent company ByteDance doesn’t sell its controlling stake by January 19, 2025.

Tok of the town

A three-judge panel in Washington DC will hear ByteDance’s appeal against the bill later today, where company representatives — as well as 8 TikTok creators — will try to block the law, per the BBC. Technically, three different legal challenges will be heard: one from ByteDance, one from creators, and one from a conservative nonprofit organization. The crux of each argument will be different, but each is likely to incorporate the issue of free speech rights for the app’s more than 170 million US users.

Lawyers from the Department of Justice will then make the case for the ban, on the grounds of what initially led to the law’s passing earlier this year: concerns that data from TikTok’s US users could be collected and exploited by the Chinese government, posing a national security risk.

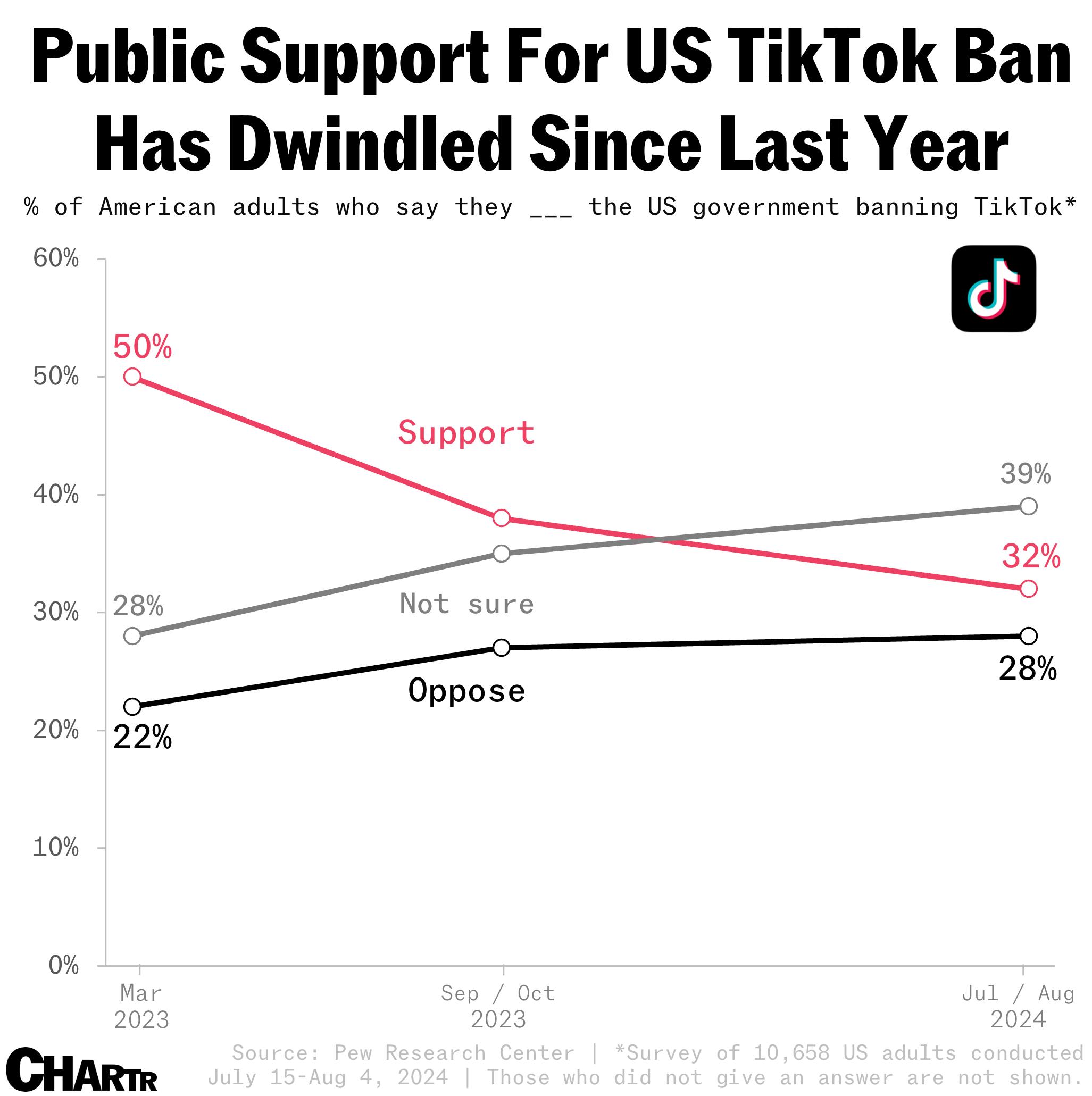

For what it’s worth, the public’s view on the issue has changed somewhat since then. A recent survey from Pew Research found that support for the ban fell from 50% in March 2023 to just 32% last month, concurrent with a relative increase in those opposing the ban, which now stands at 28%.

The idea of a TikTok ban has been kicked about the halls of Washington for years, first stealing headlines back in the summer of 2020 during President Trump’s White House tenure, before getting dropped by President Biden in 2021... then picked back up by Biden again, who officially signed the ban bill in April of this year.