INTELLIGENCE CHECK

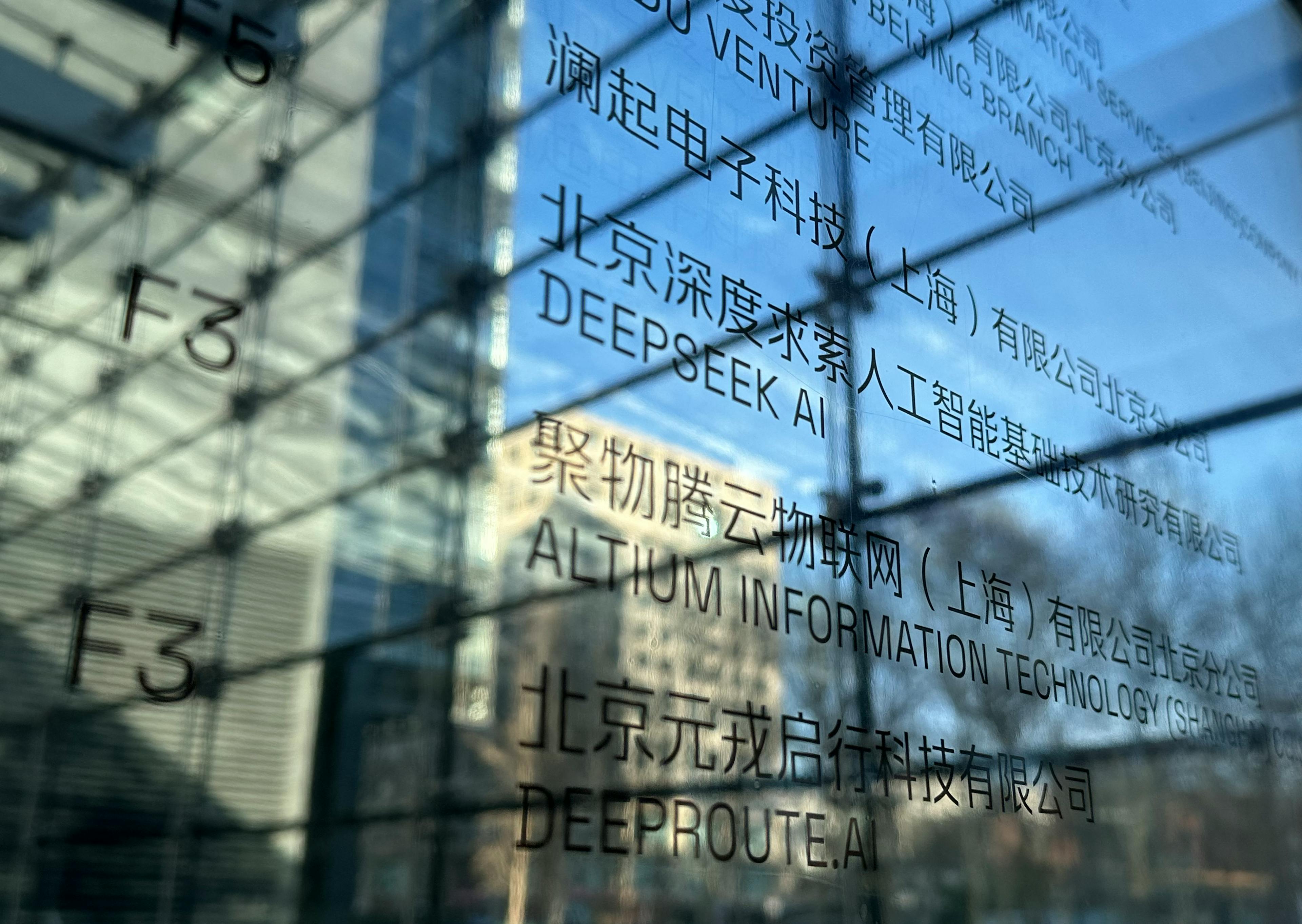

The DeepSeek freak-out should make us reconsider what’s most important in AI

Maybe we don’t want AI that’s super-integrated with lots of bells and whistles. Maybe we just want something that’s good enough and free.

The DeepSeek freak-out has gotten quieter lately. Markets have calmed. Nvidia’s stock is pulling itself out of the hole it fell into late last month. And data from Appfigures shows that downloads for DeepSeek’s AI assistant app have leveled off after their feverish start, and it’s now about as popular day to day as OpenAI’s ChatGPT.

As news reports about the new Chinese AI tool hit the web, demand for the app skyrocketed. On January 27, DeepSeek was downloaded more than half a million times on iOS and 1.2 million times on Android, almost double ChatGPT’s figures on the same day. It’s likely demand for the app was actually much higher, handicapped by both Chinese regulators limiting international users that could access it as well as a massive DDOS cybersecurity attack.

The level of hype surrounding China’s ultracheap breakthrough has helped bring the AI landscape into focus. Though OpenAI’s dominance was challenged, DeepSeek probably shouldn’t be viewed as a genuine commercial competitor to ChatGPT — if it were, it probably wouldn’t be open-source. Instead, DeepSeek’s reveal should be seen as a show of force. A “look what we can do” moment. The first salvo in what could possibly be a true AI arms race between the world’s two technological superpowers.

What hangs in the balance? Well, trillions of dollars in market capitalization, hundreds of billions of dollars of investment, huge financial outlays into infrastructure from the biggest tech companies on the planet, and the potential disruption of the future of work. No biggie!

But the entire debacle exposes a central question we weren’t really asking before that we should be asking now, in the wake of DeepSeek’s emergence: what do users actually want from AI?

Understanding what generative AI should be has been a core problem from the start. Is it essentially a nifty version of Clippy? Is it the Adobe Suite of the future? Is it a search engine killer? Obviously, OpenAI would say yes to all of the above and more. When ChatGPT launched in late 2022, it shattered growth records, gaining over 100 million users in less than two months.

But DeepSeek’s quick ascendancy seems to point to an answer here. Now that people have a sense for the way AI works, they don’t really care about the bells and whistles as long as they can get it for free.

In total, the DeepSeek AI assistant has been downloaded about 26 million times on Apple and Google devices in its first month. That’s not quite as impressive as ChatGPT’s initial numbers (or even its current numbers, as it’s gotten over 33 million downloads over the same time span), but it completely undermines the narrative that OpenAI and its competitors have been raising money on, from the likes of VCs all the way up to Microsoft, for the past five years: that AI needs to be expensive, that it has to come nicely packaged in a slick, multimodal app, and that it needs to be groundbreaking at all.

The idea that AI tools don’t actually have to be revolutionary is a huge shock to an industry begging investors for billions of dollars to continue chasing dreams of artificial general intelligence. Leaked documents show that OpenAI now internally defines AGI as “an AI system that generates $100 billion in revenue.”

DeepSeek’s real impact is showing that the industry may never get there, and putting in more computing power doesn’t guarantee more profit. Instead, the new hot commodity is what The New York Times’ Zeynep Tufekci called “artificial good-enough intelligence.”

And, as you might expect, the excitement over “artificial good-enough intelligence” is beginning to die down just weeks later. As of early February, DeepSeek and ChatGPT daily downloads were neck and neck on both Apple and Google app stores. It’s still impressive to compete with an app that regularly outpaces TikTok and Instagram in daily downloads, but DeepSeek isn’t the same kind of quantum leap as ChatGPT — it’s Coke and Pepsi.

No one downloading DeepSeek cares that it can’t “see,” can’t “talk,” and can’t generate images. They’re happy with something comparable to ChatGPT without the paid subscription. It doesn’t matter if it’s fancy, integrated well into your existing devices, or even censored, as long as it’s cheap and easy to download. Sure, DeepSeek is nowhere near as innovative as ChatGPT was, but there are a lot of people out there who drink a lot of Pepsi.

Garbage Day is an award-winning newsletter that focuses on web culture and technology, covering a mix of memes, trends, and internet drama. We also run a program called Garbage Intelligence, a monthly report tracking the rise and fall of creators and accounts across every major platform on the web. We’ll be sharing some of our findings here at Sherwood News. You can subscribe to Garbage Day here.