Adani Group, a conglomerate with sprawling interests across energy, cement and infrastructure, continues to suffer after facing allegations of fraud published by short-seller Hindenburg last week.

Hindenburg claims the Adani family has used offshore entities to artificially inflate Adani's listed company share prices, enabling them to take on more debt and leaving the group — according to the report — in a highly precarious position.

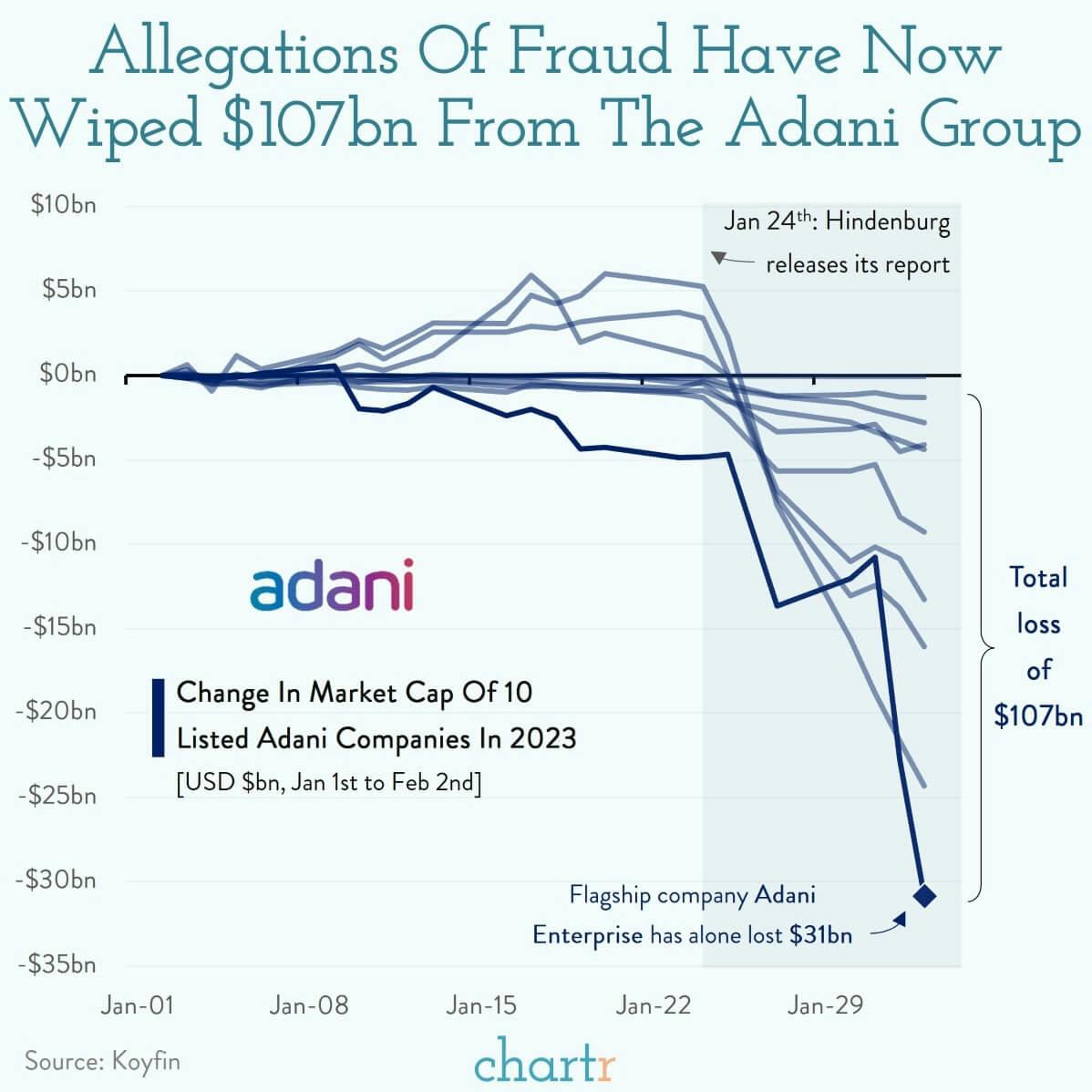

Hindenburg’s targets, which in the past have included convicted fraudulent trucking company Nikola, often see a swift share-price drop and Adani has been no exception. Indeed, the 10 listed Adani firms have now collectively lost more than $100bn in market cap since the allegations, with the flagship company, Adani Enterprises, shedding nearly 60% of its value. That has derailed a planned share offering and resulted in the founder, Gautam Adani, losing his place as the world's second-richest individual.

Rockefeller + Carnegie = Adani

It is hard to overstate how much the group resembles a modern day industrial empire. Adani runs India’s largest ports, operates ~20% of its power-transmission lines, warehouses 30% of the country’s grain, accommodates ~25% of its commercial air traffic, and produces about 20% of its cement.

When an empire of this size is accused of being “the largest con in corporate history”, the concern can quickly spread to other sectors. Adani himself, who has close ties to Prime Minister Modi, has attempted to paint the short-seller’s report as a nationalistic attack on Indian business. So far, that rebuttal hasn’t convinced investors.