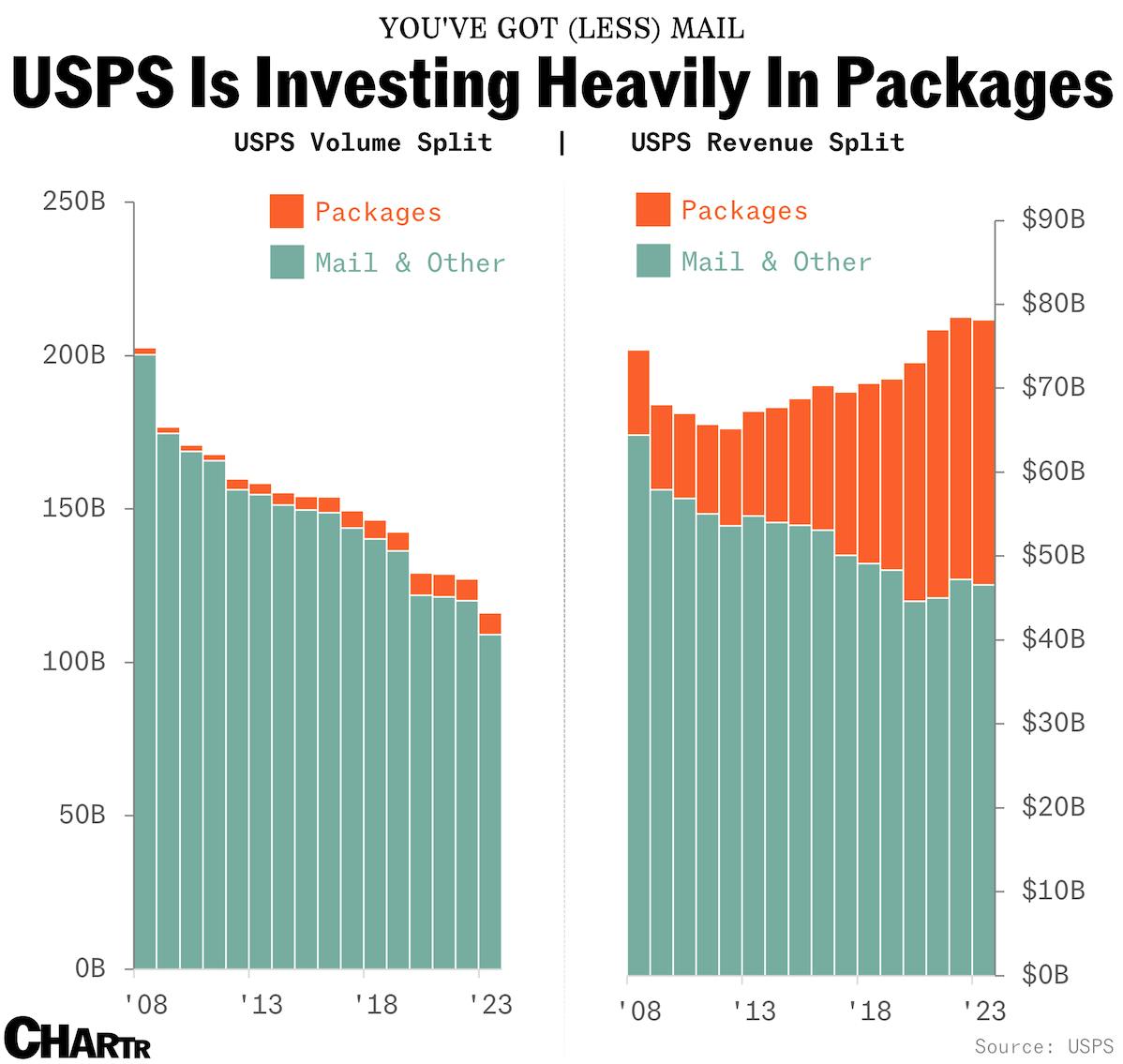

USPS is investing heavily into packages, as mail volumes decline

Keeping posted

Postmaster General Louis DeJoy’s 10-year plan to modernize the US Postal Service — and turn around cumulative losses of $98B in the past 17 years alone — has hit a snag. That’s according to reporting from the Wall Street Journal, which revealed that the new one-million-square-foot postal processing facility near Atlanta is already experiencing delays and package backlogs, despite only fully opening in February. As a result, Georgia’s inbound first-class mail took on average 2.2 days longer to arrive in March than in the same period last year.

While the sorting center has all the hallmarks of DeJoy’s $40B overhaul proposal — including advanced equipment to process high volumes of mail/packages — union leaders noted staff shortages, poor management, and overwhelmed machines among reasons for the bottleneck, citing a “rush to implement plans”.

Union scrutiny aside, a mix of soaring production costs and limits on price hikes has put the USPS firmly in the red in past years. And, with overall mail volumes declining, the institution has been trying to pivot towards the more lucrative package business to assuage losses, with 40% of its $78B of revenue last year coming from parcel deliveries, despite only making up 6% of volume. But that’s a space that’s always had serious competition in UPS, FedEx, and more recently, Amazon, which is now bigger than both of its older parcel rivals.