What’s mined is yours

Botswana is set to increase its share of diamond extraction in the country’s joint venture with mining conglomerate De Beers, rising from 25% to 50% over the next decade in a new deal struck over the weekend.

Founded in 1888 by Cecil Rhodes, De Beers quickly gained a monopolistic and controversial position in the global diamond industry, controlling a staggering 80% of supply as recently as the 1980s. Meanwhile, the company's savvy marketing also helped shape demand. With famous campaigns like “A Diamond is Forever”, the company successfully associated diamonds with love, commitment and high prices in the minds of consumers.

Carats and sticks

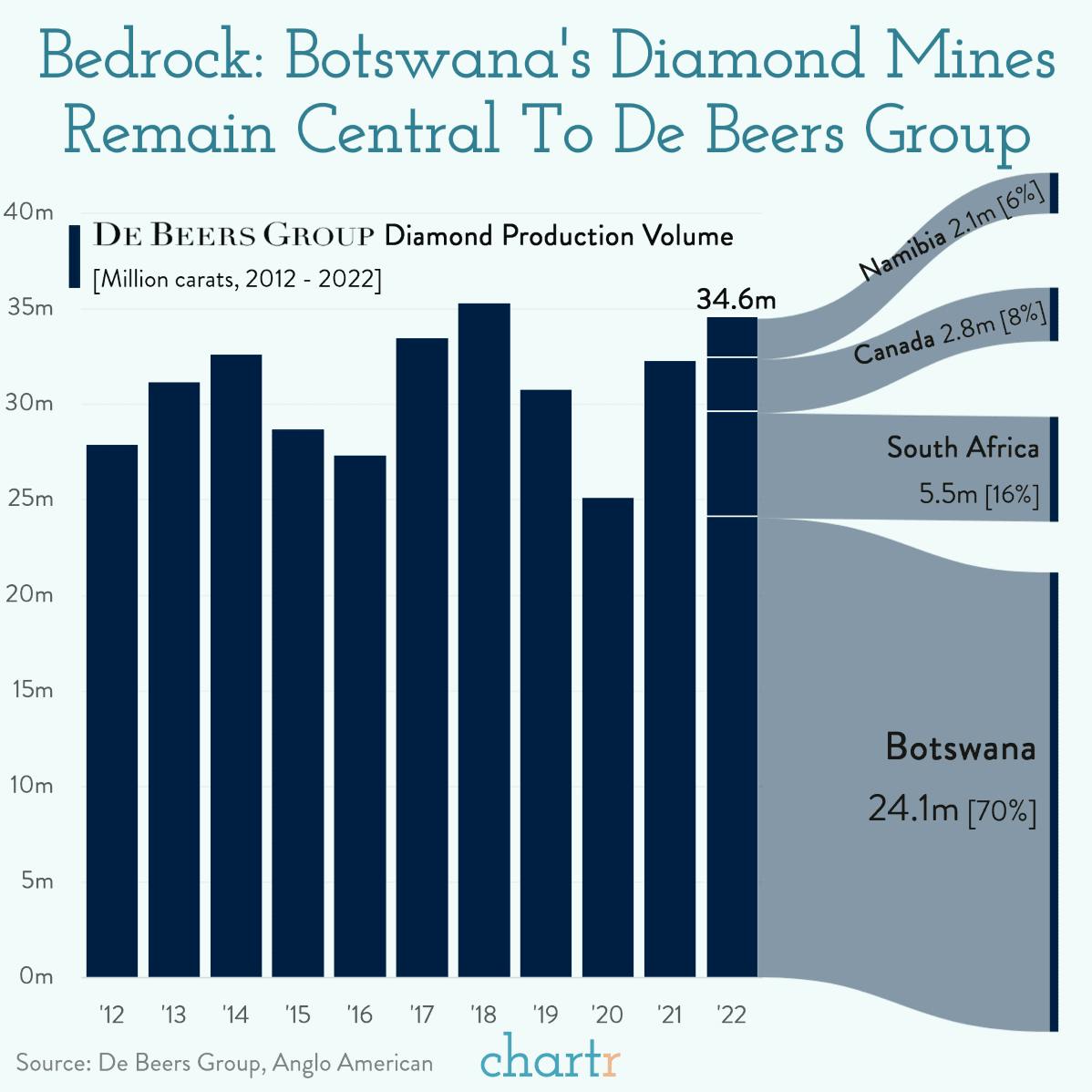

Botswana’s diamond mines — including the world’s largest open pit mine, Orapa, discovered by De Beers in 1967 just one year after the nation's independence — have helped catapult the country from one of the poorest in the world, to one with a per-capita GDP 4x the sub-Saharan Africa average. That growth, however, has come with mutual dependence — diamonds account for a staggering 90% of the country’s exports, while Botswana’s mines represent 70% of the De Beers portfolio.

After Botswana took a 24% stake in another diamond manufacturer earlier this year to diversify its route to market, and with ongoing pressure from increasingly high-quality lab-grown diamonds, this latest deal suggests that De Beers may continue to lose some of its luster.