The Super Bowl's commercials are almost as famous as the football itself, and beer brands have long been the dominant force when it comes to the big game's advertising. However, new figures from the Distilled Spirits Council, a spirits-industry group, shows it is spirit-makers that have the latest bragging rights, as spirit supplier revenues surpassed beer for the first time last year.

High spirits

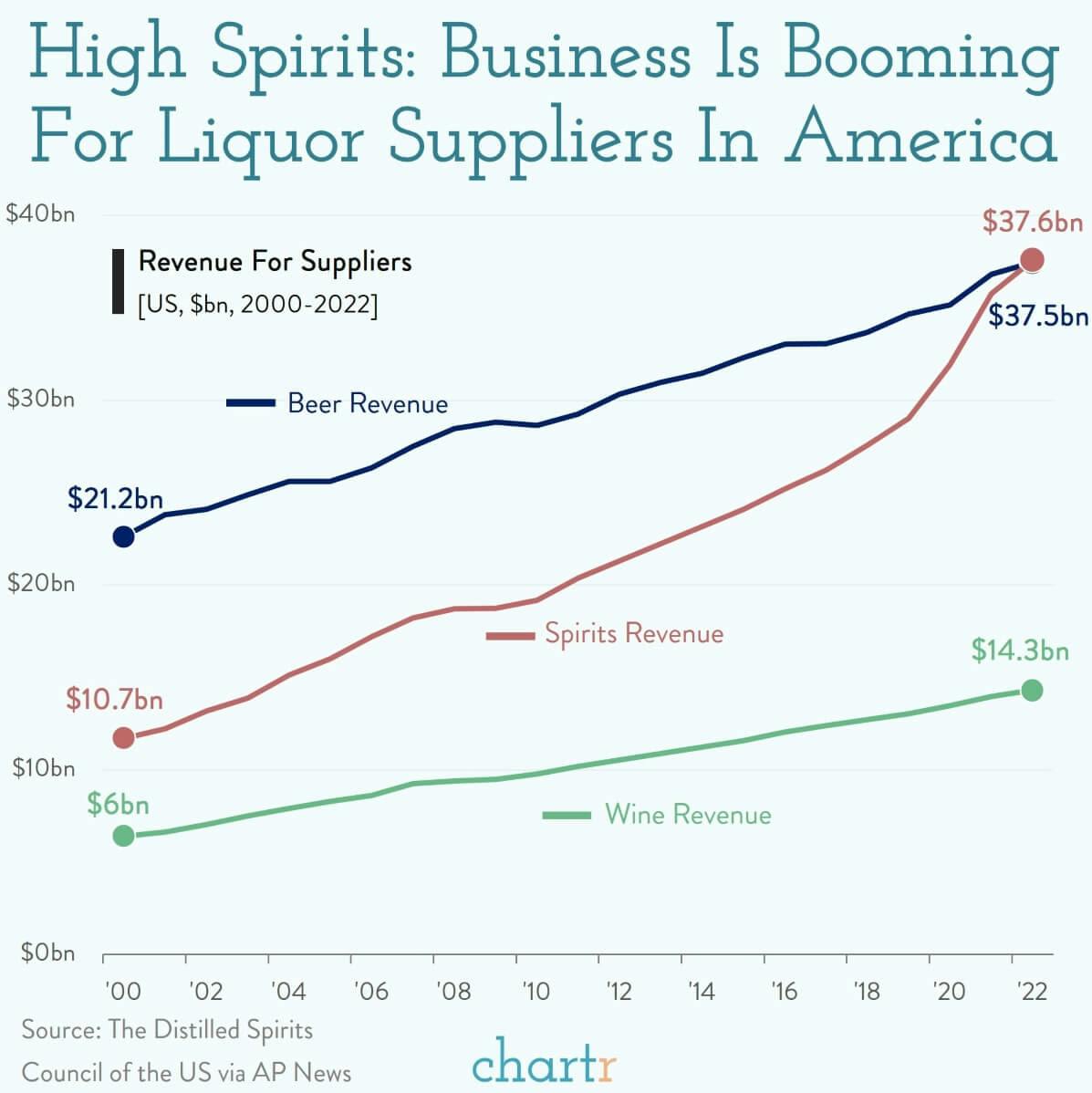

Indeed, liquor suppliers raked in $37.6bn in 2022, a 42% share of the total US alcohol market, helped by a 36% surge in sales for pre-mixed cocktails, along with rising demand for tequila and American whiskey. The sector has been on a 13-year growth spurt, gaining market share every year, taking it now past beer, which as recently as 2000 had 58% of the market.

America's love for a cold one isn't fading, but the latest data could be a sign of where things are heading as cocktail culture grows and bar-goers look for variety. Spirits may soon be a staple of those Super Bowl ads too.