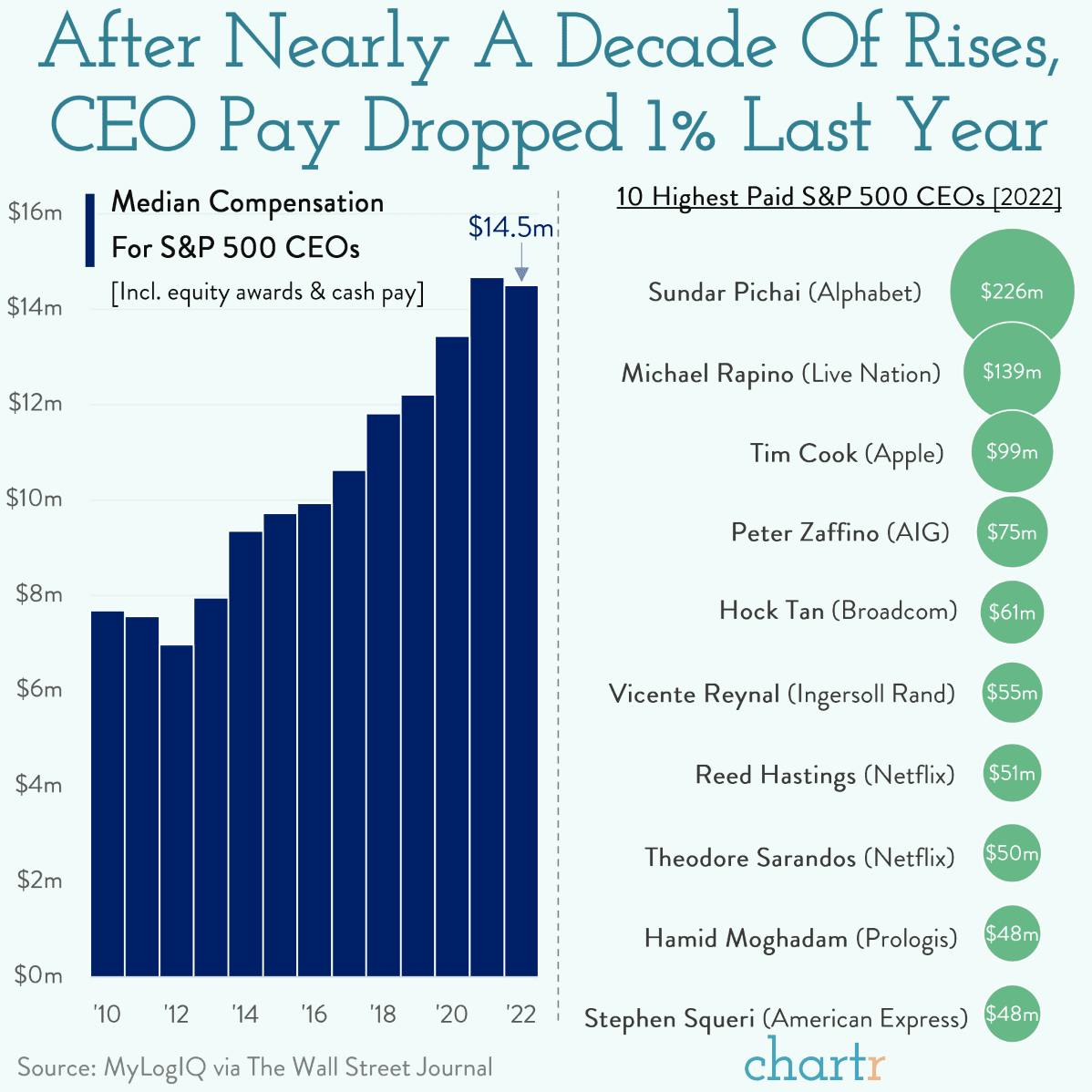

Data reported by The Wall Street Journal reveals that the median pay package for S&P 500 CEOs fell to $14.5 million in 2022, down 1% from a record $14.7 million the previous year — the first decline in a decade.

The highest-paid of the highest-paid was Sundar Pichai, CEO of Alphabet, who was awarded a staggering $226 million last year, 96% of which was from stock options. Alphabet employees are famously well compensated — the typical worker at the company made some $280,000 last year — but even in that context Pichai's figure is astonishing, with his pay more than 800 times what the median employee made.

Michael Rapino, CEO of Live Nation Entertainment, was awarded a package which was worth nearly $140m — a fact unlikely to do him any favors with Congress and frustrated Taylor Swift fans, with both having criticized the ticketing company in recent months. Elsewhere, Netflix’s co-CEOs both made the top 10 in total pay, but in different ways. Reed Hastings received almost all of his compensation through stock awards — earning a base salary of just $650,000, considerably smaller than Sarandos's $20 million salary.

Delayed gratification

Company boards love to stuff executive pay packets with stock awards, rather than salaries, because it (theoretically) aligns the incentives of shareholders and the top brass. However, because those awards typically vest over years, the CEO pay that gets reported has, historically, just been a moment-in-time snapshot. That’s something the SEC recognized, introducing a new measure of executive pay for the first time called "compensation actually paid", which takes into account share price gains and losses. Under this new measure, Pichai’s pay would fall to only $116m, while Rapino's would drop to $36m.