Belly up

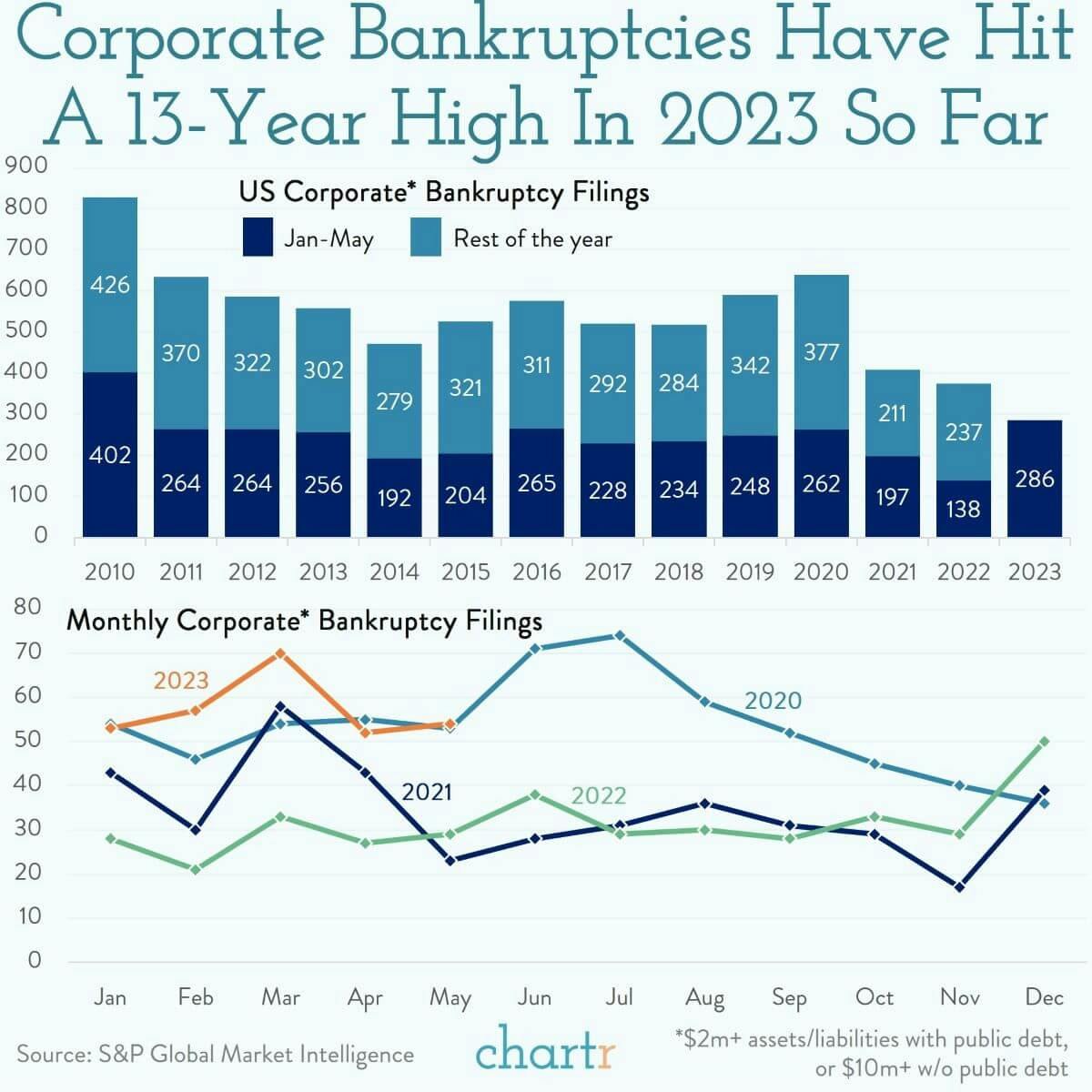

286 companies filed for bankruptcy in the US during the first 5 months of 2023, according to data released earlier this week by S&P Global Market Intelligence, the highest figure for the period through May since 2010.

There have been some pretty big names caught up in the wave of bankruptcies so far this year too, with Silicon Valley Bank’s parent company going under following the bank’s crash in March, Bed Bath & Beyond filing in April, and media disruptors Vice going in May, to name but a few.

Going under

There’s always a variety of wide-ranging factors that cause companies to go bust, but some analysts have outlined common reasons that this year has proven particularly difficult to weather for some firms. Rising interest rates and supply chain issues have been picked out, with 37 consumer discretionary businesses — companies that sell non-essential goods — filing in 2023, making it the hardest-hit sector so far.

The figure for the year so far is more than double the number recorded in 2022, when there were just 138 filings for the same period and 375 for the year in total. In 2010, the last time bankruptcies exceeded this year’s tally, the economy was still recovering from the Great Recession — the figure ended up at 828 by the year's end.