Companies that get hacked take a big earnings hit. Here's how bad it can get.

Tech outages — whether they’re caused by hacks or a widespread failure like what happened Friday — can wreak havoc on corporate America’s bottom line.

As you’ve seen in the headlines about the worldwide tech outage this morning, systems failures can hamstring businesses writ large. If you want to know what kind of financial damage a critical outage can do, look no further than a couple of earnings reports that came out this week.

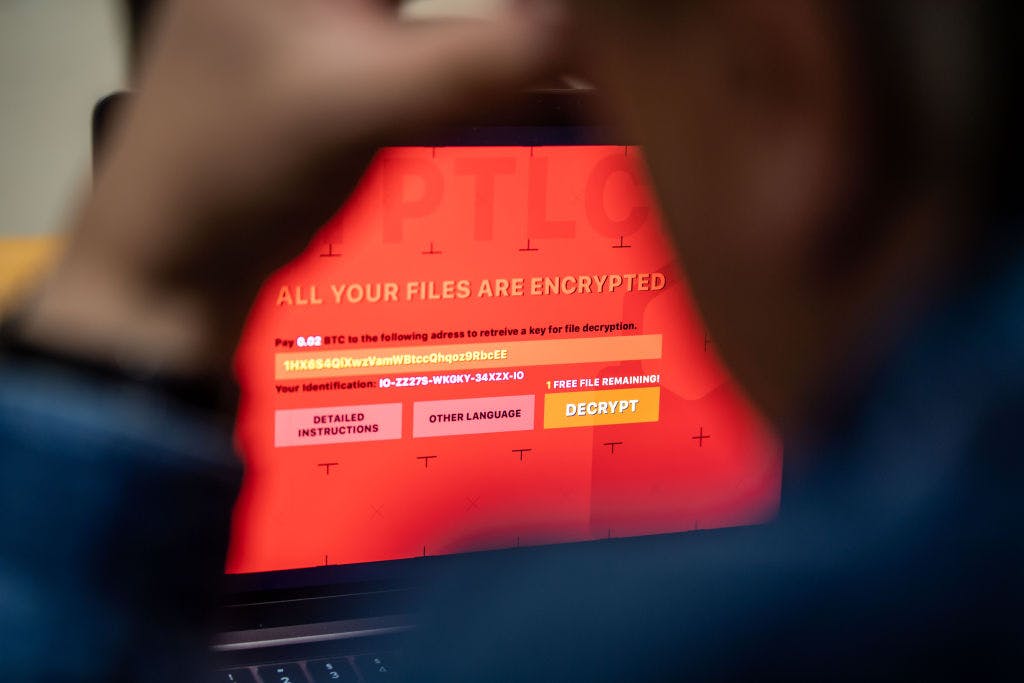

Friday’s outage was likely caused by a Crowdstrike update, but cyberattacks can knock out systems in a similar way, and sometimes for far longer. Hack-induced outages in healthcare and car-dealerships’ online systems have wreaked havoc on some industry giants’ earnings.

The US’s largest medical insurer, UnitedHealth, reported a $1.1 billion hit in its earnings report from a cyberattack that took down Change Healthcare — which operates software used for processing payments, prescriptions, and more — in February. During its call with analysts on Tuesday, UnitedHealth more than doubled its expected full-year impact from the attack from $1.6 billion to $2.3 billion, saying its business only recently started to return to its normal pace.

Over on the car lot, dealership chain AutoNation slashed its second-quarter guidance by $1.50 a share, warning its earnings would be dented by a separate, but eerily similar, cyberattack on CDK Global. CDK provides the software that dealers use for day-to-day operations like processing sales and ordering parts. When CDK went down in late June, many dealers had to go to pen-and-paper, putting their business in the slow lane for roughly two weeks — right during their end-of-quarter sales push. Most, but not all, of CDK systems have since been restored.

Investors may be feeling déjà vu: last year, MGM said it lost $100 million from a cyberattack on its underlying software that disrupted its operations for about nine days. Cyber criminals seem to have identified software that handles day-to-day operations as a crack in the foundation that can take down whole industries.