Happy Birthday Facebook

Facebook has officially left its teenage years behind, with the social networking platform that started in a Harvard dorm room celebrating its 20th birthday on Sunday.

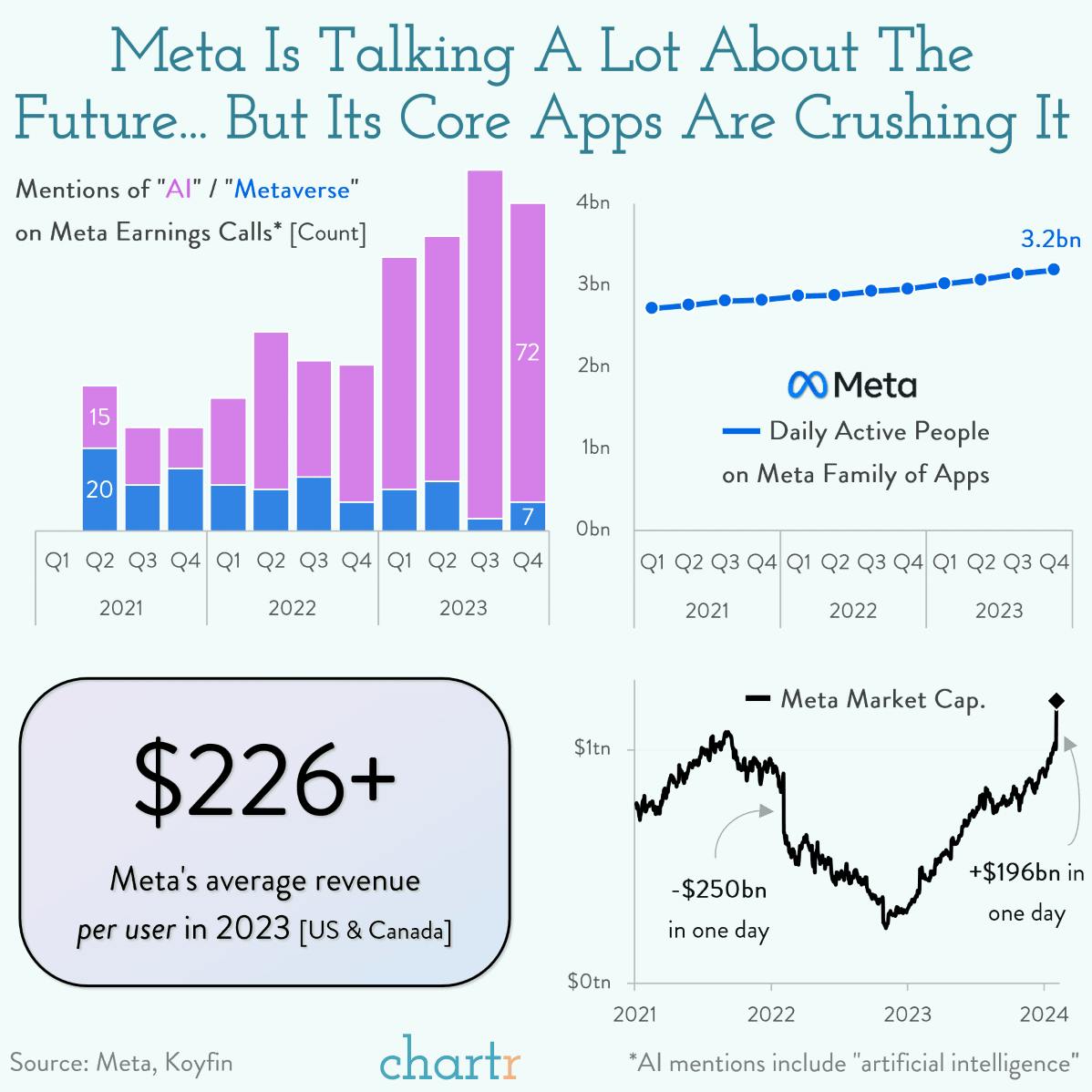

Just a few days earlier, the company’s founder and CEO, Mark Zuckerberg, was being grilled by a Senate committee over concerns about child safety on the “Family of Apps” under the holding company monolith that is Meta, which includes Facebook, Instagram, WhatsApp, and Reality Labs (Meta’s virtual reality division). However, Friday brought a more celebratory itinerary for Facebook execs, as Meta reported a lights-out quarter, sending shares up more than 20%, adding $196bn to the company’s value — the largest one-day gain in Wall Street history.

For investors, there was a lot to like about Meta’s update. Yes, the company is still talking a lot about the metaverse — and spending billions of dollars trying to build it — but its core social media business is so wildly profitable that we’re running out of superlatives to describe it.

Instagram vs. Reality

Somehow, 20 years on from Facebook’s founding, the company is still signing up new accounts, with daily active users hitting 3.19 billion — and now, Meta is better than ever at monetizing those eyeballs. Indeed, the average US or Canadian user was worth an eye-watering $226 in revenue for Meta last year. That means the company is extracting $18+ of value from you every month, holding your attention with content that — for the most part — has been uploaded freely to its platform, without costing Meta a single dollar.