Liftoff

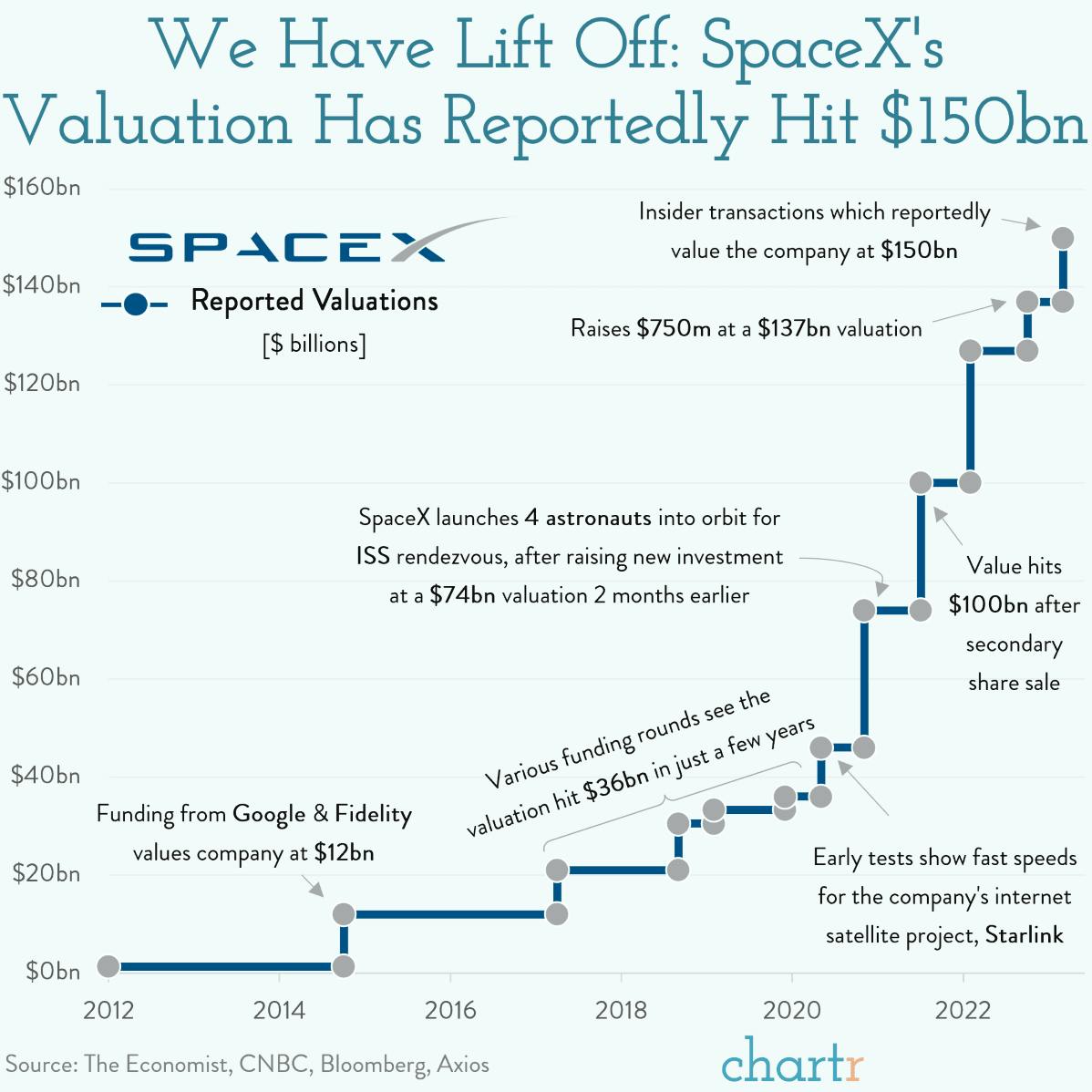

SpaceX is reportedly looking to sell insider shares at $80 apiece — a price point that would propel the valuation of the company to an astonishing $150bn, making it the second most valuable startup in the world, second only to TikTok owner Bytedance.

Founded in 2002 by Elon Musk, SpaceX was created to revolutionize space transportation, with a longer term goal of one day colonizing Mars. However, the venture — perhaps unsurprisingly — quickly proved to be an expensive undertaking. After initially looking to reuse old Russian rockets, the SpaceX team realized they might be able to make the rockets cheaper themselves. Various failed launch attempts (and flirtation with bankruptcy) ensued before the company started to prove itself. External funding came in waves, and every milestone from reusable rockets to crewed missions saw SpaceX’s credibility, and its valuation, grow.

The wifi frontier

The company has significantly increased the number of satellites and rockets it launches into space, becoming the busiest rocket launcher globally. Such expertise has enabled SpaceX to build out its network of Starlink satellites, which aim to provide global internet access. There are now more than 4,000 satellites in its “Wifi constellation” — and the company has reported having 1.5 million subscribers.