Uber is finally profitable, so what’s next?

Robotaxis and more labor disputes, of course

Uber’s meteoric rise since its founding in 2009 — built on the simple question “What if you could request a ride simply by tapping your phone?” — made it a poster child for the industrial “disruption” that Silicon Valley entrepreneurs sought to unleash on the world.

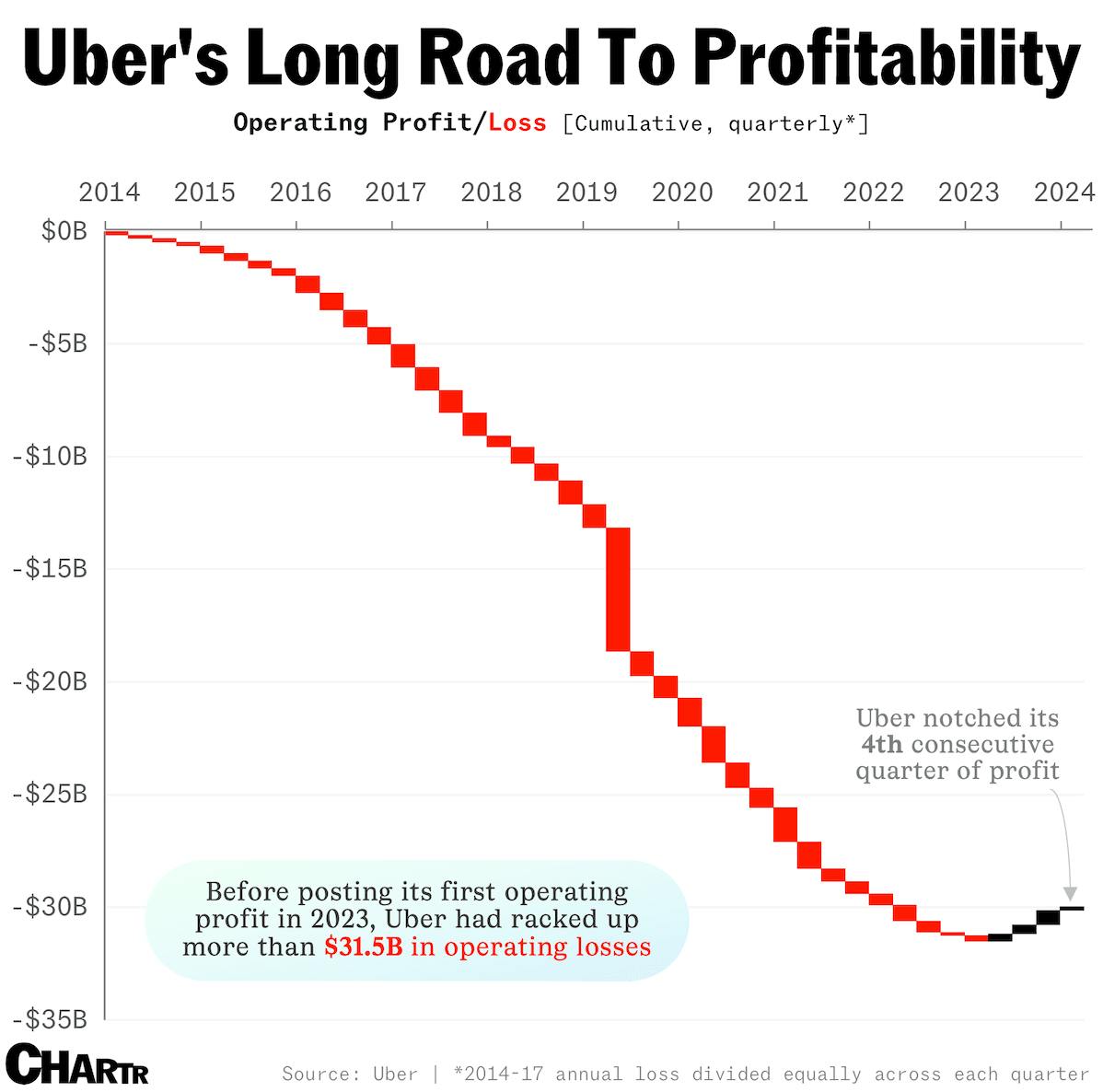

But, despite its impact, Uber lost money for years.

Launching in new cities wasn’t cheap: drivers had to be enticed, marketing campaigns had to be executed, new servers had to be spun up, and expensive lawyers had to interpret local rules and regs — whatever their advice, Uber’s strategy seemed to be “launch first, answer questions later” — and, of course, in-demand software engineers had to keep the app running.

You’ve arrived

In 2019, The Economist wondered aloud whether Uber would ever be profitable. The classic refrain from the company and its investors was that at a certain scale, it would be. It first had to get big enough and outlast enough of its competition. As it turns out, they were pretty much right.

Last year, Uber had its first annual profit, and recent quarters have also been solidly in the black, with investors expecting another profitable quarter to be announced on August 6th. The company’s main rival still hasn't quite reached that scale. Lyft has narrowed its losses significantly, but is still in the red.

But, question marks continue to hang over Uber’s business model. The most important remains, as it has always been, how it treats its drivers, and to this day the company faces labor disputes, lawsuits and scrutiny over its definitions of employment. The company is well aware of these issues. Indeed, in any 10-K SEC Filing, after a brief description of what a business does, the first section is always “risk factors.” Topping the list of risks for Uber is still to this day:

Our business would be adversely affected if Drivers were classified as employees, workers or quasi-employees instead of independent contractors.

Last year, Uber and Lyft won a $205 million challenge in California, allowing them to keep their workers classified as contractors. However, this victory came with concessions, requiring the companies to offer workers certain benefits, including healthcare and accident insurance.

Just 3 weeks ago, Uber and Lyft agreed to settle a longstanding dispute in Massachusetts, agreeing to pay $175 million to resolve claims that the two companies had violated state labor laws. They agreed to pay the drivers a minimum rate, and give them other benefits, but — crucially — the companies can continue to classify their drivers as independent contractors.

Big city life

In London, Uber has faced challenge after challenge. Its most recent is a £250 million ($323 million) legal case brought against it in May from the city’s famous black cabbies, who allege that the company misled Transport for London about how the Uber app actually worked when it obtained a license to operate in the city. In New York, the legal disputes have been equally fast and furious. Since the company’s entrance into the city in 2011, Uber has turned the taxi industry upside down, surpassing NYC taxis in daily trips by mid-2017.

Locked out

The latest news out this week, per Bloomberg, is that the city’s taxi commissioner is exploring new rideshare driver pay rules after allegations that Uber had begun locking NYC drivers out of its platform during periods when demand was low. By shutting drivers out of the app, Uber was reportedly skirting a 6 year-old rule requiring them to pay drivers for the idle time in-between rides, with some drivers reporting that they had gone from making $300-400 per shift to just $170-200. This kind of cat and mouse with policymakers has been a theme of Uber’s time as a globally important company.

Robotaxis

While regulation remains the biggest short-term threat to Uber’s business, the longer-term threat — or opportunity, depending on how you see it — is from technological change, with the rise of autonomous vehicles (AVs) and their potential as on-demand robotaxis.

That future might not be as far away as it feels, as in the US you can currently take a robotaxi in four cities: San Francisco, Phoenix, Los Angeles, and Las Vegas.

Obviously for Uber, eliminating the need for human drivers would offer an opportunity to capture a larger share of each transaction. However, its own self-driving experiment faced setbacks, including a lawsuit from Alphabet against its self-driving truck startup Otto for alleged IP theft, and a fatal accident involving one of its vehicles in 2017. As the pandemic struck, Uber decided to exit the costly AV race entirely, selling its self-driving unit for $4 billion in 2020. Since then, it has pursued a partnership strategy, collaborating with startups like Motional and its former rival, Waymo.

Today, only 56% of Uber’s revenue comes from rides. That is why self-driving cars are potentially so valuable for the company — they have the potential to revolutionize all three lines of business that it's in. Indeed, just 3 weeks ago the company announced a multi-year combination with Aurora, that will “see Aurora’s autonomous driving technology offered on the Uber Freight network through 2030”, per TechCrunch.

CEO Dara Khosrowshahi has even suggested potential collaboration with Tesla on its much-hyped but long-overdue self-driving vehicles (Elon Musk once said there would be a million Tesla robotaxis on the road by 2020). However, with Musk delaying Tesla's robotaxi reveal that was planned for next month, any formal agreement seems likely to be a long way off.

Khosrowshahi expects a “relatively long period” of transition when both human drivers and AVs are on offer. During that period it’s easy to rationalize situations in which drivers’ wages could rise or fall — indeed drivers might find themselves able to offer a “premium human experience”.

But, once self-driving cars are widespread in major cities, the question remains: who will benefit the most — customers, platforms like Uber, or vehicle owners?