Royal pennies

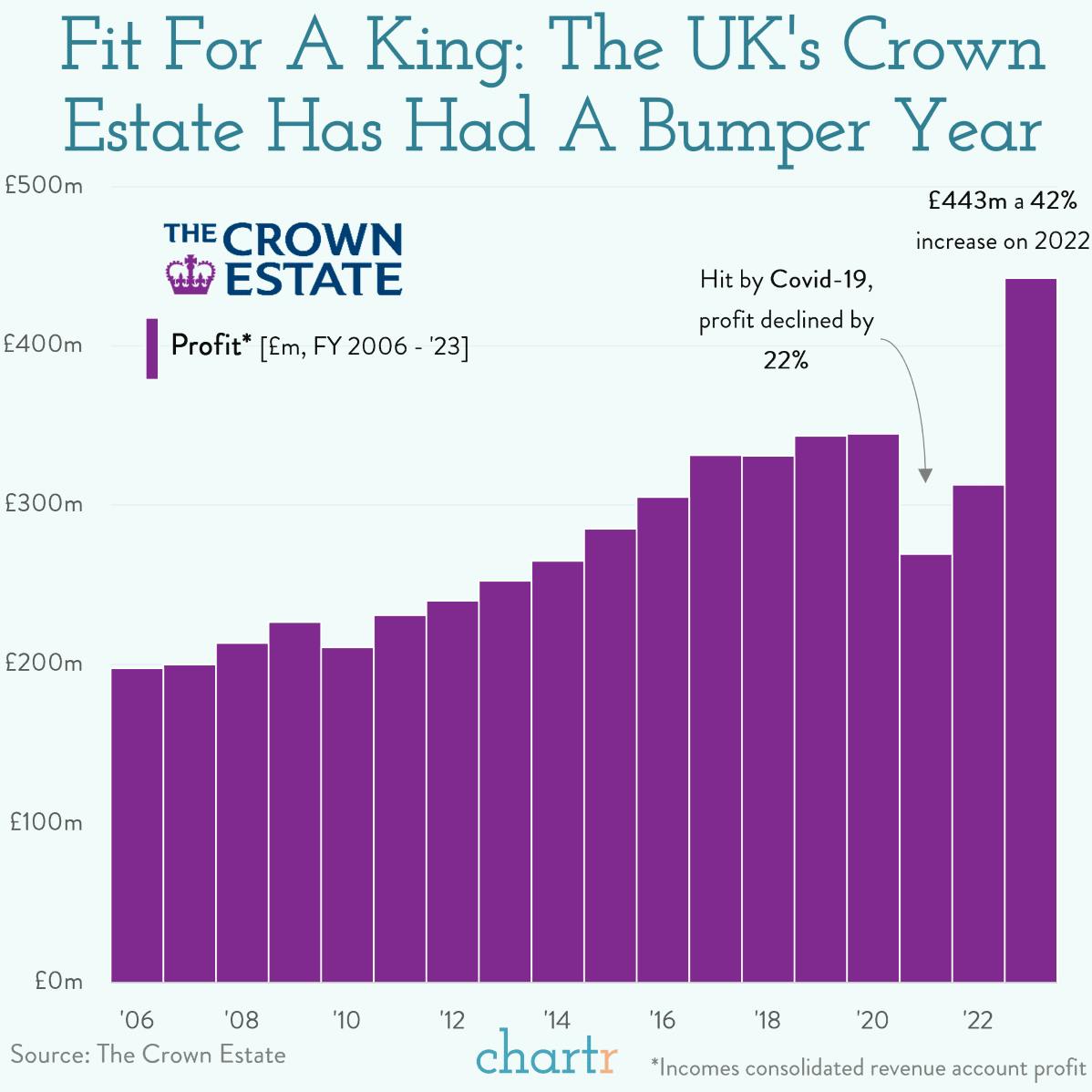

The Crown Estate, the property management company for the British Monarchy, announced a surge in income to £443m (~$560m) in the past financial year, an impressive 42% increase from the previous year. Little to do with the transition of power or the pomp and ceremony of the recent coronation, the recent rise is attributed mostly to renewable energy companies paying The Crown Estate — which owns the 12 nautical miles of seabed surrounding Britain — for the rights to build 6 new offshore wind farms capable of powering up to 7 million homes.

Since the reign of King George III, the monarchy has relinquished control of the Estate's revenue to the Treasury. This arrangement has relieved the monarch of various responsibilities and rights, but in exchange, the royal family receives an annual payment known as the Sovereign Grant. In recent years the Treasury has returned up to 25% of the profits back to the royal household, which could have been up to £111m this year.

Regal reserves

However, despite the rise in profit, the Government announced that this year's Sovereign Grant would be broadly unchanged at just over £86 million, with the funding formula also now under review, as the Estate is expected to benefit from a continued rise in wind power profits. £86m is a pretty penny, but with repairs at Buckingham Palace — which is undergoing a renovation costing some £369m — and the costs of both the Queen Elizabeth II funeral and the King’s coronation, total spending hit £108 million last year, meaning the Royals had to draw £21 million from reserves to fund the royal year.