Universal Music shares jump after announcing new Spotify deal

It’s Spotify ft. UMG forever.

Universal Music Group (UMG), the world’s leading music company, and Spotify, the world’s most popular audio-streaming service, yesterday announced a new, multiyear agreement for recorded music and music publishing — sending shares in Universal Music up 7% in early European trading on Monday morning.

The agreement will establish a direct license between UMG’s publishing arm and Spotify’s product portfolio to usher in the “next era of streaming innovation”... which sounds good? It will also, per the press release, introduce new paid subscription tiers and offers, bundle music and nonmusic content together, and ensure artists’ streaming royalties.

Bright spot

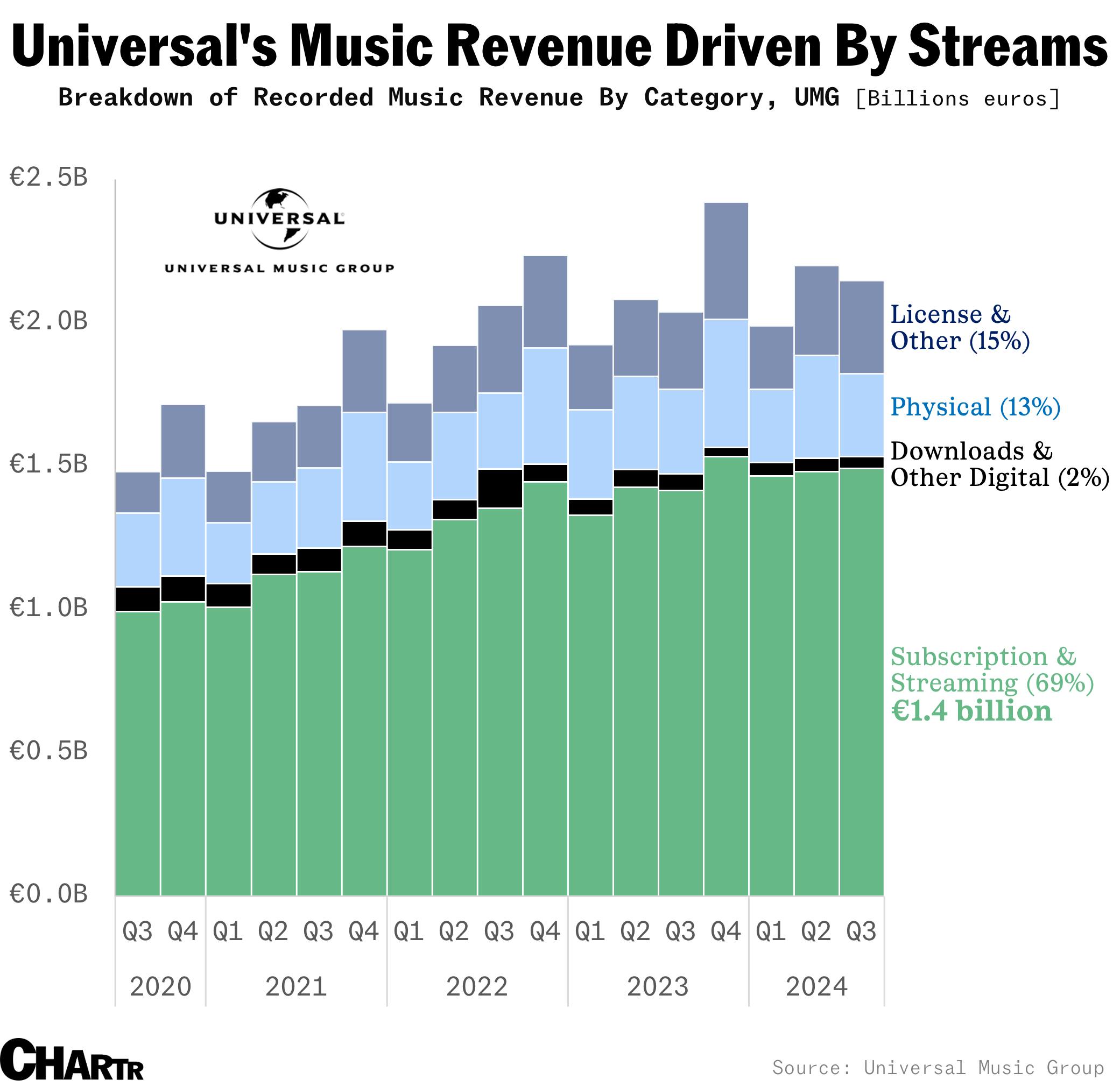

The deal comes a month after UMG announced an “expanded global relationship” with Amazon Music, and extends a long-standing partnership between two industry behemoths. Over the last decade, streaming has fast become one of UMG’s biggest meal tickets, making up almost 70% of the company’s recorded music revenue in Q3 2024, equivalent to almost $1.5 billion in just three months.

As stated in the joint press release, UMG and Spotify will work to advance “greater monetization for artists and songwriters” — though it is notably light on specific details as to how that will be achieved. But one thing we know for sure is that the audience experience will be... “deepened.”

Indeed, streaming royalties remain one of the music business’s most controversial issues, and Spotify is often at the center of those conversations. (The platform’s CEO recently faced backlash for price hikes and layoffs amidst record profits.) While the deal stands to benefit UMG’s major artists like Taylor Swift and Kendrick Lamar, unsigned songwriters are likely to be largely left out of this “mutually beneficial relationship” — particularly in light of Spotify’s 1,000-stream monetization threshold, set in 2023.