GoFundMe (treasury edition)

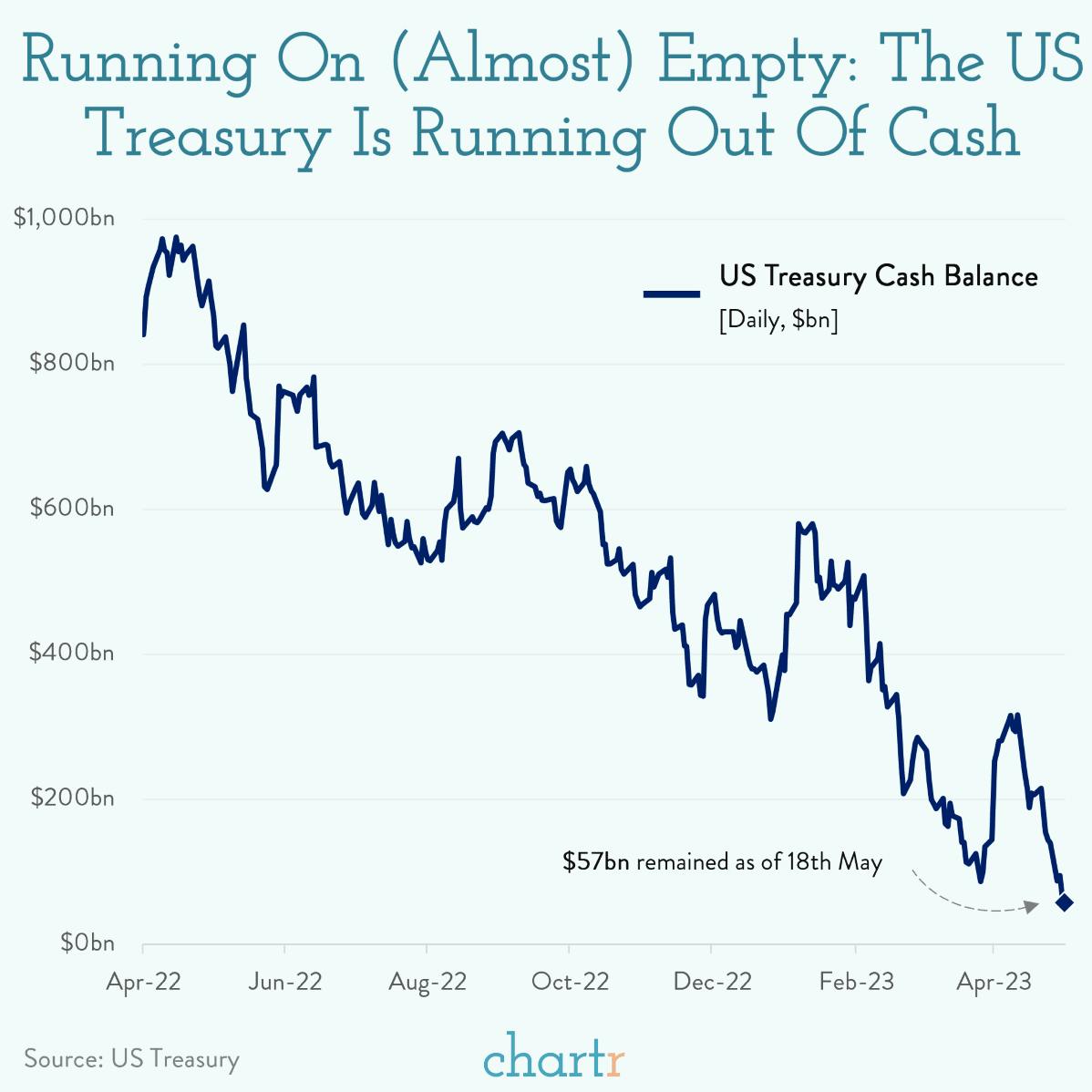

The US treasury’s cash balance has dipped below $100bn, further ramping up the pressure on lawmakers to solve the impending national debt crisis.

Although it’s volatile (like personal bank balances often are), the treasury’s cash pile of $57.3bn, recorded last Thursday, is by far the lowest figure for more than a year — and it’s well below the $150bn minimum that the treasury reportedly likes to keep as a buffer.

The X-date

Treasury Secretary Janet Yellen has said to lawmakers that the “X-date” — the date when the US can no longer guarantee its ability to pay bills — is June 1st. If the US government does run out of money, the biggest problem is a default on its debt. Most analysts agree that a default would lead to complete financial chaos but the reality is that it’s anyone’s guess, because it’s never happened before.

The current debt ceiling stands at a whopping $31.4 trillion, legally limiting how much the treasury can borrow.

Talks between President Biden and Speaker Kevin McCarthy are set to resume today, as each side negotiates the latest fiscal package that would raise the limit, though both parties remain ideologically opposed on whether the new debt ceiling should come with deep cuts to, or caps on, federal spending.