Not a care in the world

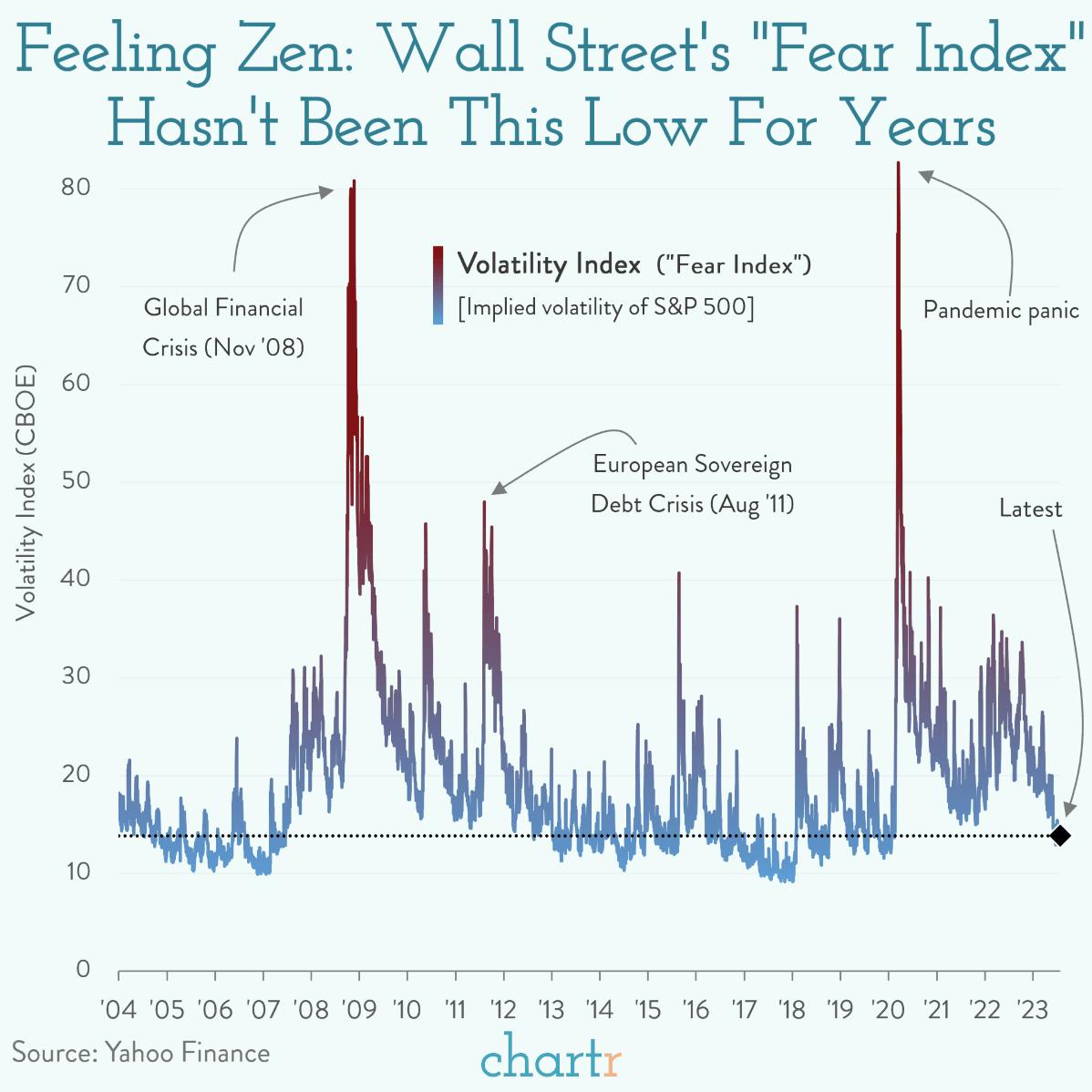

US stocks have climbed 19% already this year, taking the flagship S&P 500 Index to just a few percent below its all-time high from December 2021. Meanwhile, Wall Street’s “Fear Index” — the Volatility Index (VIX) — is scraping new lows.

The VIX tracks how much investors expect stock prices to fluctuate over the coming month. In simple terms, when the VIX is higher, it means investors expect prices to move around a lot (i.e. they're more uncertain), and when it's lower it means they don't expect prices to move around much.

The latest reading is a little over 13. The last time it was this low? February 2020, just before the pandemic sent it above 80 — the kind of "call your family and go full panic mode" readings that are only seen in global crises.

Explaining why stocks are doing what they're doing is notoriously difficult, but at least 3 things seem to be helping investors get comfortable. The big one is inflation, which has peaked and looks to be falling steadily, giving the Federal Reserve leeway to slow down on future interest rate rises. Another is the banking sector, which is reporting strong results after a big wobble earlier this year, when a number of banks suddenly collapsed. More generally, the risk of a recession also seems to have receded, with consumer confidence levels hitting their highest point in 2 years and unemployment hovering near all-time lows in many states.