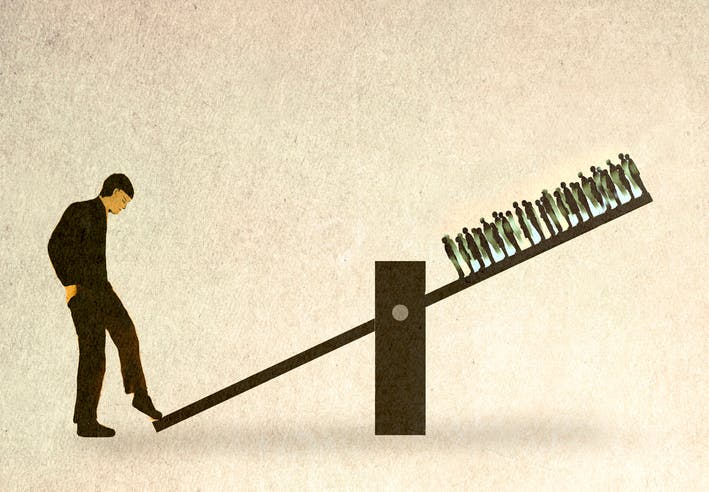

America’s top 1% now holds nearly a third of household wealth

Stock market rallies have added trillions to the fortunes of the wealthiest people in the US.

The wealth of America’s top 1% surged to a record $52 trillion in the second quarter, according to new Federal Reserve data.

Every wealth group saw gains over the past year, but the biggest boost went to those at the upper end. While the bottom half’s wealth rose 6.3% from a year earlier, the top 1% saw their fortunes climb some 8.5%, now commanding nearly a third of the nation’s total wealth.

Indeed, that share has climbed steadily over the past 35 years, fueled largely by stock market gains. The top 1% now owns roughly half of all corporate equities and mutual fund shares, up from 42% in 1990. In contrast, just 12.8% of those assets are held by the bottom 90%, whose portfolios rely more heavily on real estate, a sector that lagged stocks through much of the last decade’s bull run — and again into 2025, per a note from Goldman Sachs’ Global Investment Research division last week.

Meanwhile, uneven wage growth is also driving the so called “K-shaped economy.” According to the Bank of America Institute, after-tax wages for low-income households grew just 0.9% year over year in August, the slowest pace since 2016. For higher earners, wage growth hit 3.6%, the fastest since late 2021.

Spreading (some of) the wealth

From a macro view, though, the picture isn’t entirely grim. With the top 40% of earners driving more than 60% of total US spending, Goldman Sachs estimates that “positive wealth effects” from rising asset prices have lifted annualized consumption growth by 0.3 percentage points in Q3, reversing a drag earlier this year. If asset prices keep pace with nominal GDP, that spending engine could keep humming into 2026.

Still, Goldman warns that a market pullback could quickly turn that boost into a slowdown. Moody’s chief economist, Mark Zandi, also told CNBC that an economy “powered in big part by the spending of the extraordinarily well-to-do” could face a “serious threat” if their portfolios start flashing more red than green.