SoFi soars as GOP cuts to federal student loans move toward passage

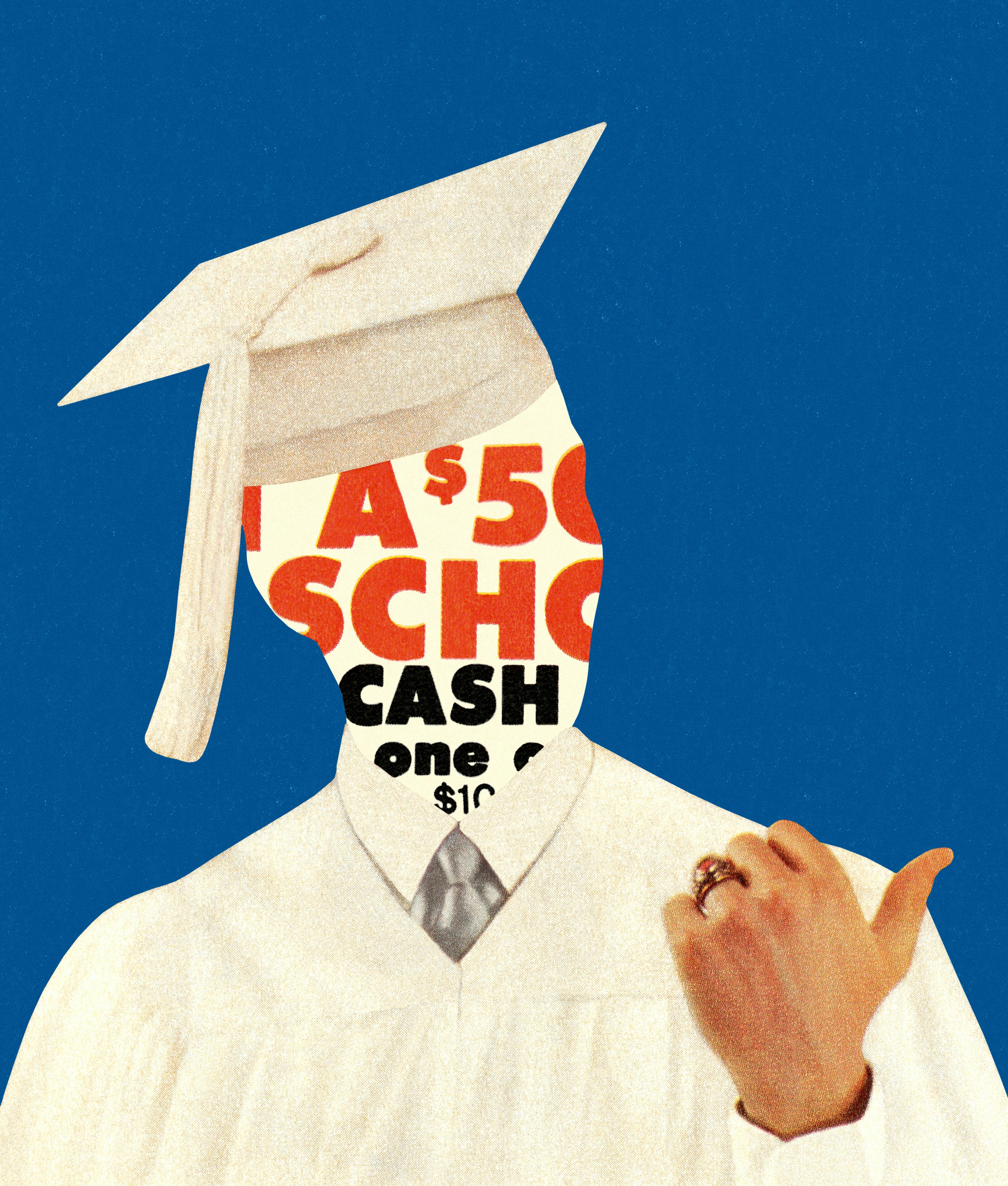

Cuts to federal student loan programs would likely move more borrowers to private lenders.

Student loan lender SoFi Technologies hit its highest price since November 2021 on Monday as Senate Republicans moved forward on President Trump’s giant budget bill, which would cut federal student lending programs and likely push borrowers to private lenders like SoFi.

Trading in bullish call options surged on the day, helping to catalyze a run-up of more than 10% in early trading. The shares gave back some of those early gains, but remained up more than 6% in the last hour of trading.

As the Washington Post reported in May, the bill would radically change, and in some cases, complicate, the current student lending system in the US.

The bill includes changes like cutting the Pell grants used by students from poor and middle-class families, ending the federal PLUS loan programs for graduate students, and imposing new limits on the total amount that can be borrowed for advanced degrees, such as medicine and law, to $150,000 and $100,000 for master’s degrees. The Post reported:

“Republicans say imposing borrowing limits on graduate programs could force institutions to lower their costs. But the restrictions may simply drive more students to the private lending markets, where there are fewer consumer protections, said Jon Fansmith, senior vice president for government relations at the American Council on Education (ACE).”

That’s how SoFi CEO Anthony Noto seems to see the situation as well.

On the company’s post-earnings conference call in late April, he told analysts, “If the government backs away from providing in-school loans, Grad PLUS, et cetera, et cetera, we’ll absolutely capture that opportunity.”