Gilded Lilly

Yesterday, pharma giant Eli Lilly announced the launch of ‘LillyDirect’, a direct-to-consumer telehealth service designed to simplify medicine deliveries for users, particularly for popular weight-loss drugs like the newly approved Zepbound. The service will widen access to the medicine, which has exploded in popularity, with tens of thousands prescriptions for the drug being filled every week, often at a list price of more than $1,000 per month.

Bigger pharma

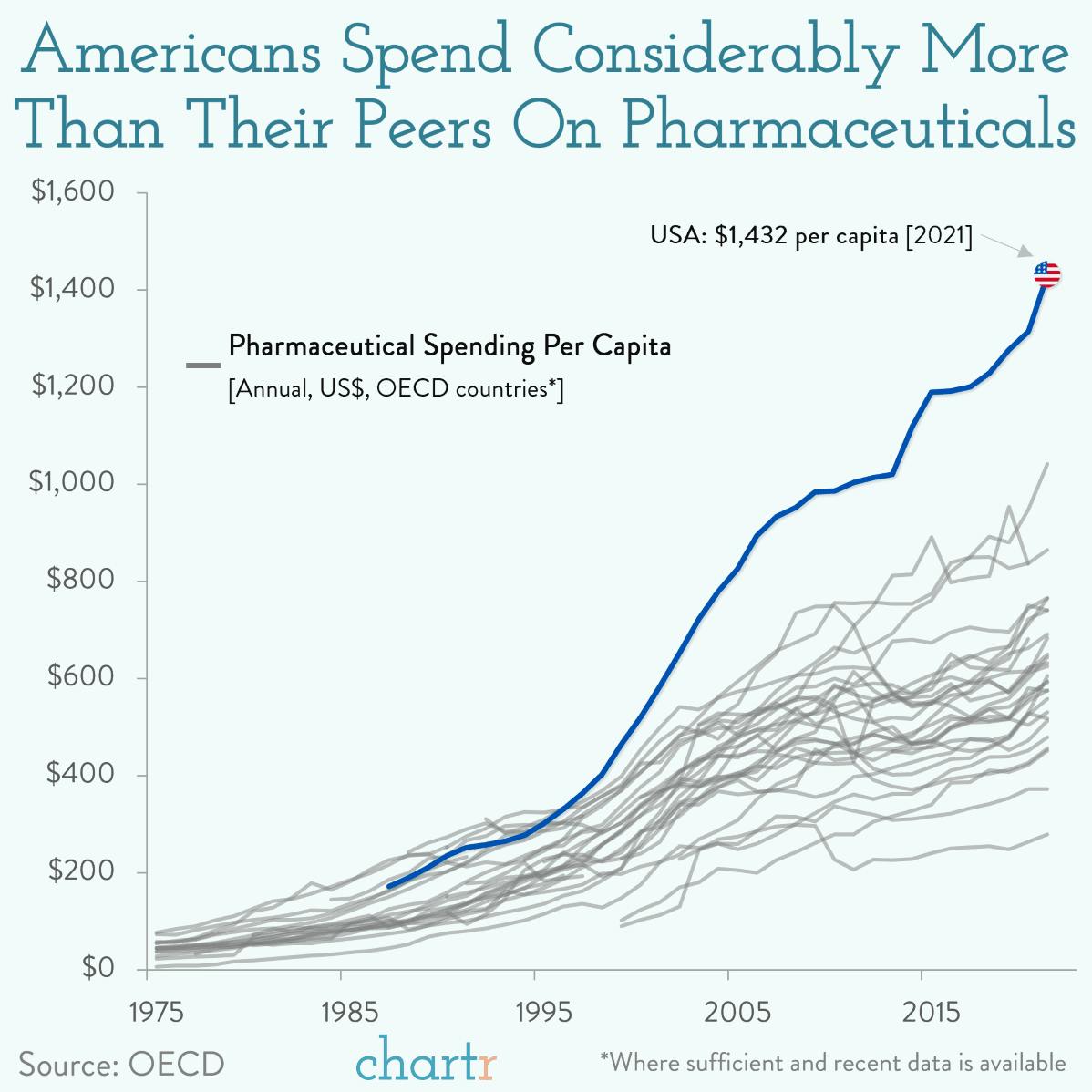

Alongside similar direct delivery offerings from CVS Health, Walmart, and others, Lilly’s move is the latest in an industry shift towards cutting out pharma middlemen to combat continuously surging costs. Data from the OECD reveals how sharply US pharmaceutical costs have soared relative to global counterparts — in 2021, American spending on pharmaceuticals broke the $1,400 barrier. That’s some ~$390 more per person than in Germany, the second-highest spending country.

Interestingly, Eli Lilly’s strategy isn’t anything particularly novel. Going direct to consumers has been a focus for companies in a swathe of industries for years, with everything from sportswear (Nike, Lululemon), to eyeglasses (Warby Parker), and even mattresses (Casper, Emma) being sold straight to customers. What’s different this time is that it’s healthcare, an industry notorious for multiple layers of costs between patients and providers.

Weight Watchers — which has moved into providing weight-loss drugs itself and has rebranded as WW — saw its stock slim down on the news, falling 12% yesterday.