Pay a visit

Following the devastating wildfires seen across Hawaii last August, the island state is considering a new tourist tax to fund conservation and restoration projects in hard-hit regions such as Maui.

Gov. Josh Green proposed a $25 “climate impact fee” for vacationers in his second State of the State Address. The tariff is projected to bring in tens of millions a year — with half earmarked for disaster insurance to encourage investment in high-risk areas, as well as fire breaks to shield vulnerable communities.

Paradise lost

This isn’t the first time Hawaii has attempted to pass a similar bill: in April, lawmakers debated a $50 annual green fee that would grant visitors access to parks and beaches; however, that proposal failed in the final hours of a legislative session. Since then, last summer’s wildfires — the worst disaster in Hawaii state history — have caused an estimated $4-6 billion in economic losses, burning thousands of acres of land.

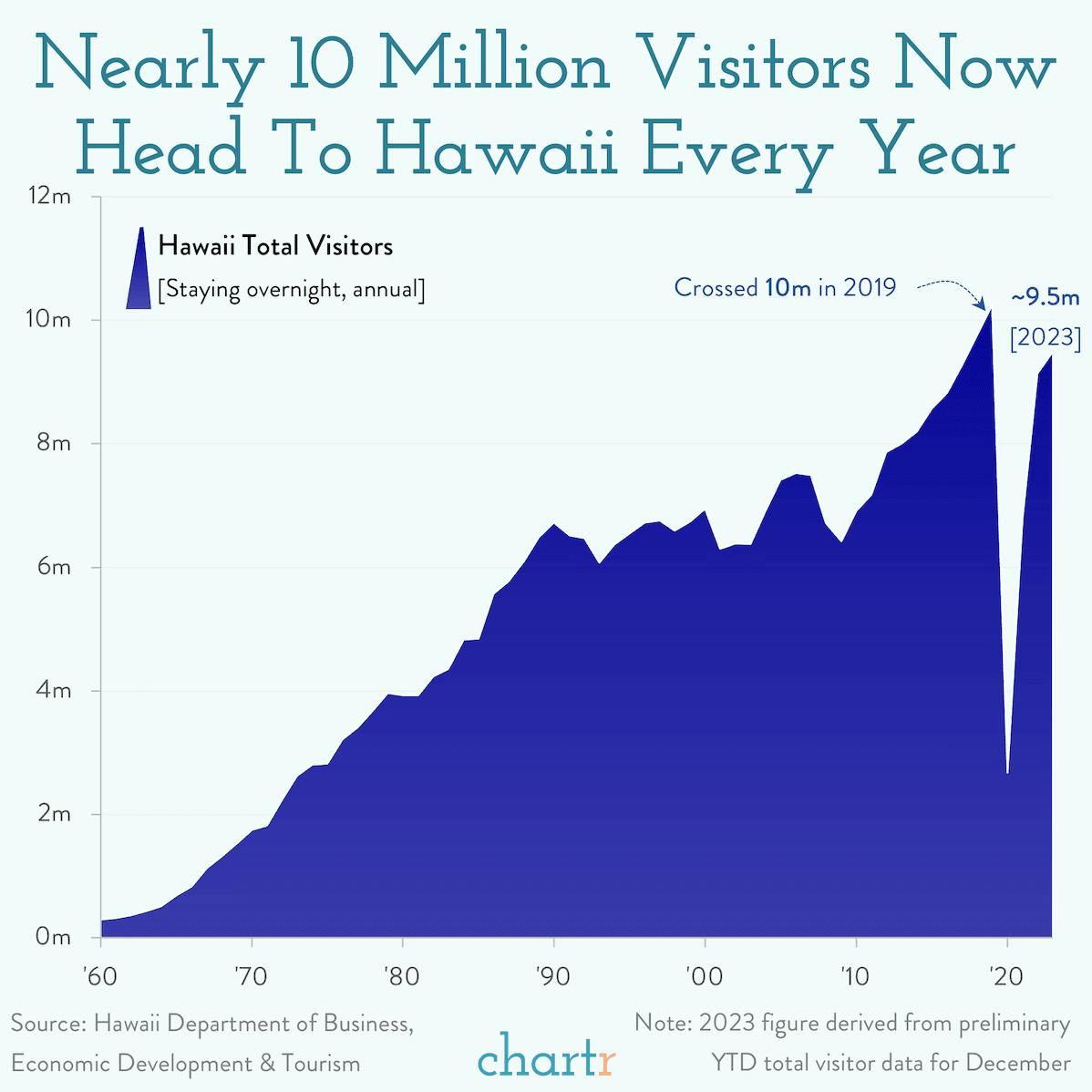

The urgency to protect Hawaii’s natural assets comes as tourist numbers have soared, recording around 10 million visitors in 2019, roughly 7x the state’s ~1.4 million residents. Although the vacationer count hasn’t quite recovered since the pandemic, the state’s reliance on tourism means that the loss of its renowned scenery comes with both ecological and economic consequences — in 2022, tourism was estimated to make up ~18% of Hawaii’s GDP.

Zooming out: Many tourist hotspots are enacting similar legislation: from this spring, Venice is charging a €5 day rate to mitigate damage; Bali recently introduced a $10 sustainability fee; and in Greece, which was also ravaged by wildfires in 2023, a “climate resilience fee” is now added onto lodging bills.