SnackTime

“It’s the pre-internet age, pre-video, early-video-game world, right?”

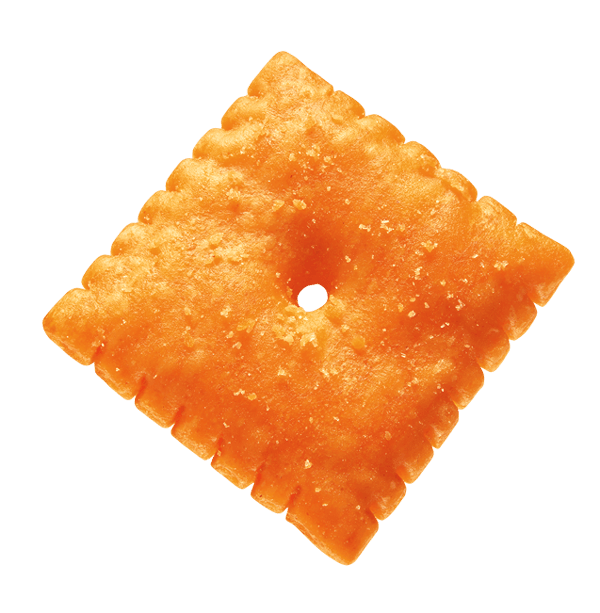

The only thing Americans can agree on is that they all like Cheez-Its

Taco Bell collabs, pop-up shops, and lots of nostalgia are keeping the cracker in the minds and mouths of consumers.

Snack brands face a constant challenge to reinvent themselves to attract young customers. But beyond revamping packaging or creating relatable but sometimes cringey social-media presences, one brand has managed to stay above the fray: Cheez-It.

This year alone, Cheez-It launched two activations (think: a campaign, event, or interaction that generates brand awareness). It collaborated with Taco Bell on a Big Cheez-It Crunchwrap Supreme (basically a regular Crunchwrap Supreme but with a giant Cheez-It cracker wrapped in the flour tortilla) and a Big Cheez-It Tostada (a giant Cheez-It topped with ingredients like beef and vegetables), which rolled out last month. In May, the brand debuted a limited-time-only Cheez-It diner in upstate New York that featured Cheez-It-inspired décor, milkshakes, and traditional diner-food items that incorporated the cracker.

Last year Cheez-It teamed up with Nail Inc. for a nail-polish collection that featured appropriately themed orange and red. They hosted a pop-up gas station in Joshua Tree park with a gas pump that dispensed bags of crackers.

Beyond activations, Cheez-It has been consistently coming up with fresh variations of its product. The brand has an ongoing partnership with Hidden Valley; Cheez-It x Hidden Valley Ranch Crackers debuted in June. In January, “extra crunchy” Cheez-It crackers hit shelves, following “snap’d (a more chip-like cracker) and “puff’d” (more like a cheese puff) varieties.

Cara Tragseiler, a senior brand director for Cheez-It, said consumer data helped shape the creation of the new cracker. The “Kellanova Proprietary Salty Snacks Demand Landscape Research” study from 2021 suggested that 60% of snackers preferred something crunchy. Tragseiler said Kellanova is focusing on how “Cheez-It can create unique experiences and transform snacking occasions.”

But it’s the Taco Bell collab and pop-up diner that’ve become popular fodder for food critics and food content creators, especially on TikTok and Instagram Reels. While such marketing activations can cost thousands of dollars, it may be worth it given the traction they get on social media.

Staying relevant is a challenge for a brand like Cheez-It, which is over 100 years old. Last year, its parent company, Kellogg, split into two independent publicly traded companies — WK Kellogg Co and Kellanova — with the former focused on the cereal business and the latter on the global snack brands Cheez-It, Pringles, Pop-Tarts, and Rice Krispies Treats.

In its latest quarterly earnings report, Kellanova reported $3.2 billion in revenue, a 4.3% decline from the year before, but still slightly exceeding initial expectations. Its organic net sales rose 5.4%, which signaled underlying growth.

During the earnings call in May, Kellanova CEO Steven Cahillane seemed confident and optimistic about the growth and trajectory of the brand after two quarters following the spinoff.

He talked about how the brand’s crackers and salty snacks saw an “upward trajectory” — specifically citing increasing merchandising for Cheez-It.

Eric Dahan, the founder and CEO of creator commerce agency Mighty Joy, said that the marketing team behind Cheez-It — and Kellanova as a whole — is clever enough to know how to launch exciting collabs and activations.

“There’s clearly a big drive happening here,” Dahan said. “It is quite smart to be tapping into these cultural moments. I also think it's smart to be expanding the brand because there is a lot of competition from others making these sorts of snacks.”

Brands like Cheez-It have an aging audience that tend to respond to nostalgia marketing campaigns, but they also need to reach younger folks like Gen Z, an age group who has a strong interest in experiencing the periods they didn’t grow up in, Dahan said.

“Gen Z does have a lost nostalgia especially for the ’90s because they didn't really grow up in the ’90s,” Dahan said. “It's the pre-internet age, pre-video, early-video-game world, right? Brands really benefit from understanding and tapping into that.”

Interestingly, despite the demand for organic, healthier snacks, Cheez-It has not attempted to tap into the “better for you” food marketplace. Todd Irwin, founder and chief strategy officer of Fazer, a New York brand strategy and creative agency, said it’s impressive that Cheez-It has managed to maintain its popularity especially considering health trends.

“The battle to stay relevant and not have to completely change their ingredients profile is a battle that's been going on for at least 20 years and maybe longer,” he said. “It increasingly becomes more relevant year after year because of health trends — especially the trends against ultraprocessed food. So what do they have to do? They have to figure out ways to become relevant to Gen Z and young people.”

Irwin said that Cheez-It has been successful in evoking emotion, which goes back to the point of nostalgia and brand recognition.

“If you’re talking about products that don’t have any health benefits at all, they’re constantly trying to find handles on how to attach the brand to an emotion with something as specific as a food or artist,” Irwin said.

He pointed to how PepsiCo brands like Mountain Dew have successfully partnered with popular celebs like Nicki Minaj, Lil Wayne, and Tony Hawk through the years.

“People want to be associated with brands that are associated with the people they look up to, so it's all about brand association,” Irwin said. “With Cheez-It, it’s ‘how do we associate ourselves with Taco Bell enthusiasts?’”

Finally, he added that the diner experience is smart, too, because it’s marketed as a local country diner that generates word of mouth.

“Just doing things off the beaten path, as opposed to just straight advertising about your flavors,” Irwin said. “People want fun, and that’s the bottom line.”

Saleah Blancaflor is a freelance journalist who covers business, entertainment, culture, and lifestyle.