DroneDash

On Friday, DoorDash announced it was piloting — quite literally — a new partnership with Alphabet’sWing division, testing drone delivery for orders at a select Wendy’s in Virginia.

If you don’t happen to live within 2.5 miles of the Christiansburg, VA location, this news probably won’t revolutionize your food-ordering habits overnight, but it is a sign of how seriously platforms are thinking about using drones in the highly competitive world of “last-mile logistics”. For DoorDash, the rollout builds on its pilot Wing partnership in Australia, which has expanded to 3 locations following extensive testing.

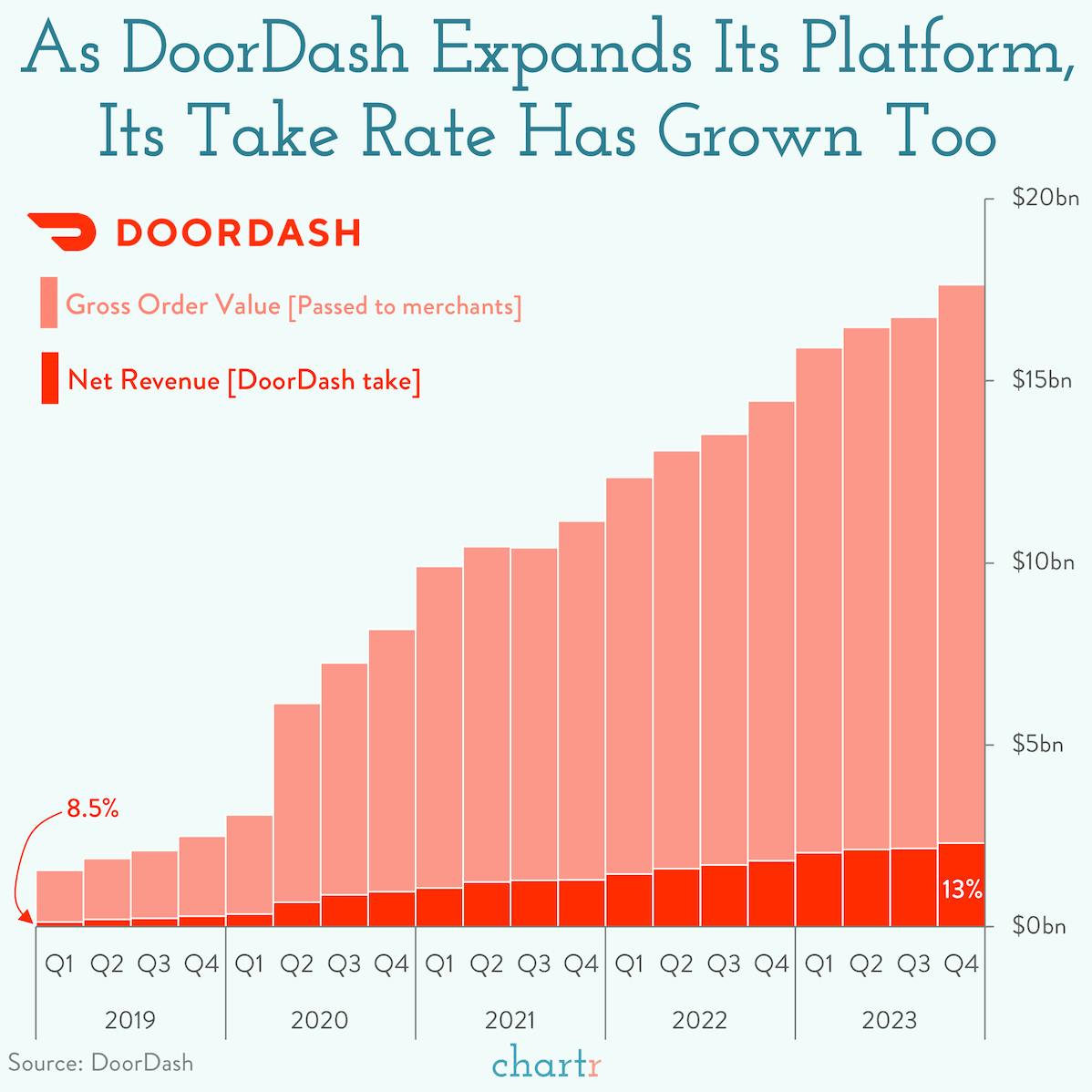

Take rate tipping point

DoorDash, like UberEats, Grubhub, and others, makes its money by charging fees — for everything from service to delivery — on its in-platform sales. In recent years, the overall take rate for its services has risen: in Q1 2019, DoorDash reported taking 8.5% of the total order volume through its platform as revenue; last year, that figure was 13%.

Although it’s a long way from being a mainstream option, drone delivery would tip the balance of power even further in favor of food-ordering platforms. Indeed, it’s easy to imagine DoorDash being able to charge restaurants and hungry customers a larger fee when they have a fleet of drones whizzing burgers, noodles, and pizza across America at 65mph.

Droning on: In 2013, Jeff Bezos boldly predicted that Amazon could be drone delivering in 5 years... it has taken a lot longer, but the company does offer a limited drone service at 2 locations in California and Texas.