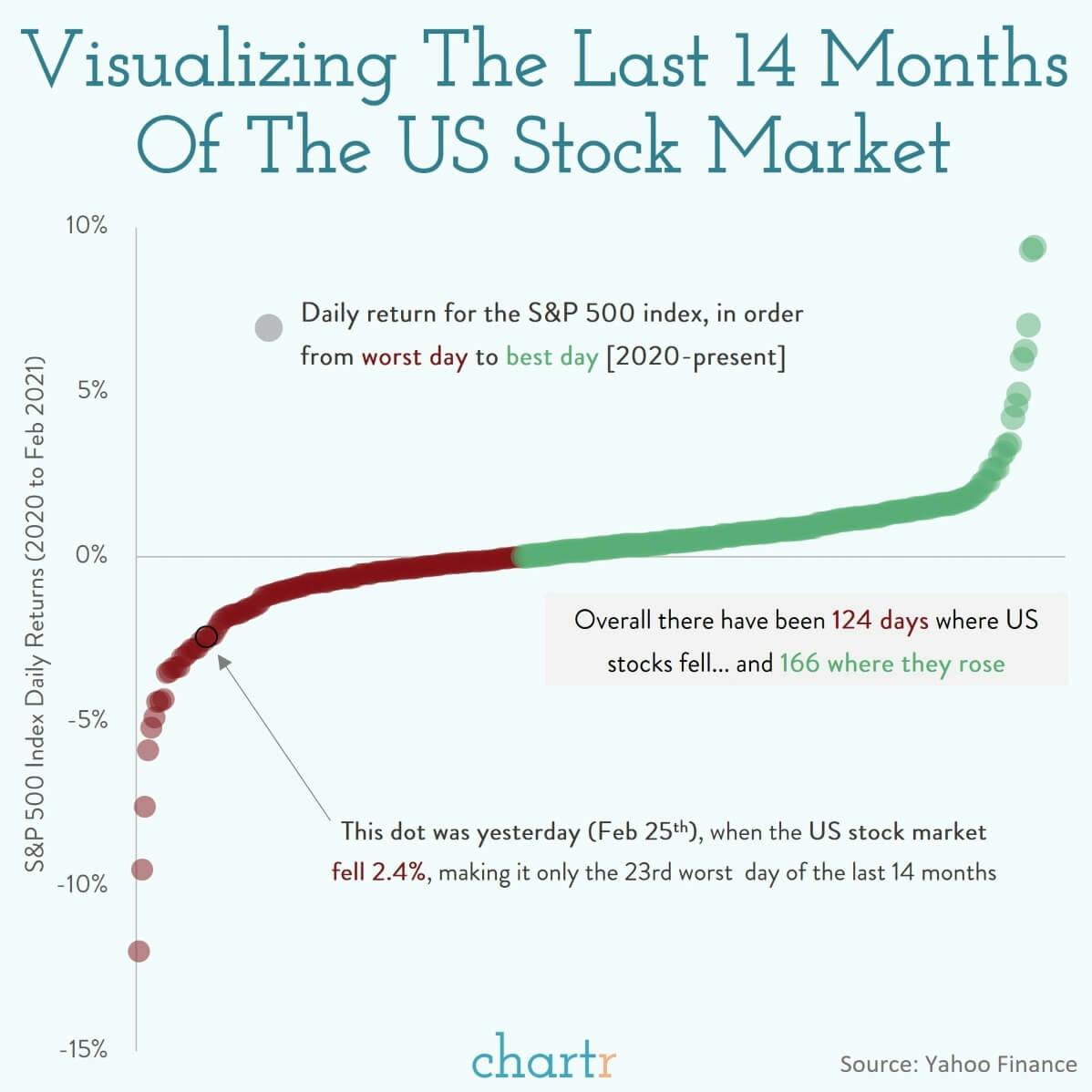

Visualizing the US stock market: We put yesterday's stock market moves into some recent context

US stock markets fell almost 2.5% yesterday, as fears about rising inflation spread from the bond market into stocks. In more normal times, a fall of that magnitude would usually rank among the worst days in a year — but not since the pandemic. The fall yesterday is actually only the 23rd worst day since the start of 2020, and it is still nothing on the ~12% drop that happened on March 16th 2020 when panic gripped investors at the beginning of the pandemic.

Stocks only go up?

Tech stocks got hit particularly hard yesterday. Apple fell 3.5%, Facebook3.6%, Airbnb was down 9% and Tesla fell 8%. For retail investors that have piled into tech stocks since the start of the year, this probably came as a shock to the system after so many days in the green.

Whether yesterday proves to be just another minor hiccup on the unrelenting upward march that tech stocks have been on, or something more serious, is probably going to depend on the actual inflation data. Investors have been expecting higher inflation for a while — something we wrote about 2 weeks ago — but it's yet to really show up in a significant way; meaning that it's going to be all eyes on the next inflation data release (March 10th, bet you can't wait).

One stock that didn't go down yesterday was — you guessed it — GameStop. Much to the delight of traders on Reddit, GME shares gained another 18%, taking the stock back over $100, the highest it has been for a number of weeks but still a far cry from the $347 the shares closed at back in January.