Shares in ride hailing company Lyft briefly surged more than 60% in after-hours trading yesterday, in response to the company publishing optimistic guidance on its journey toward sustainable profits… an outlook that proved slightly too good to be true.

Decimal, placed

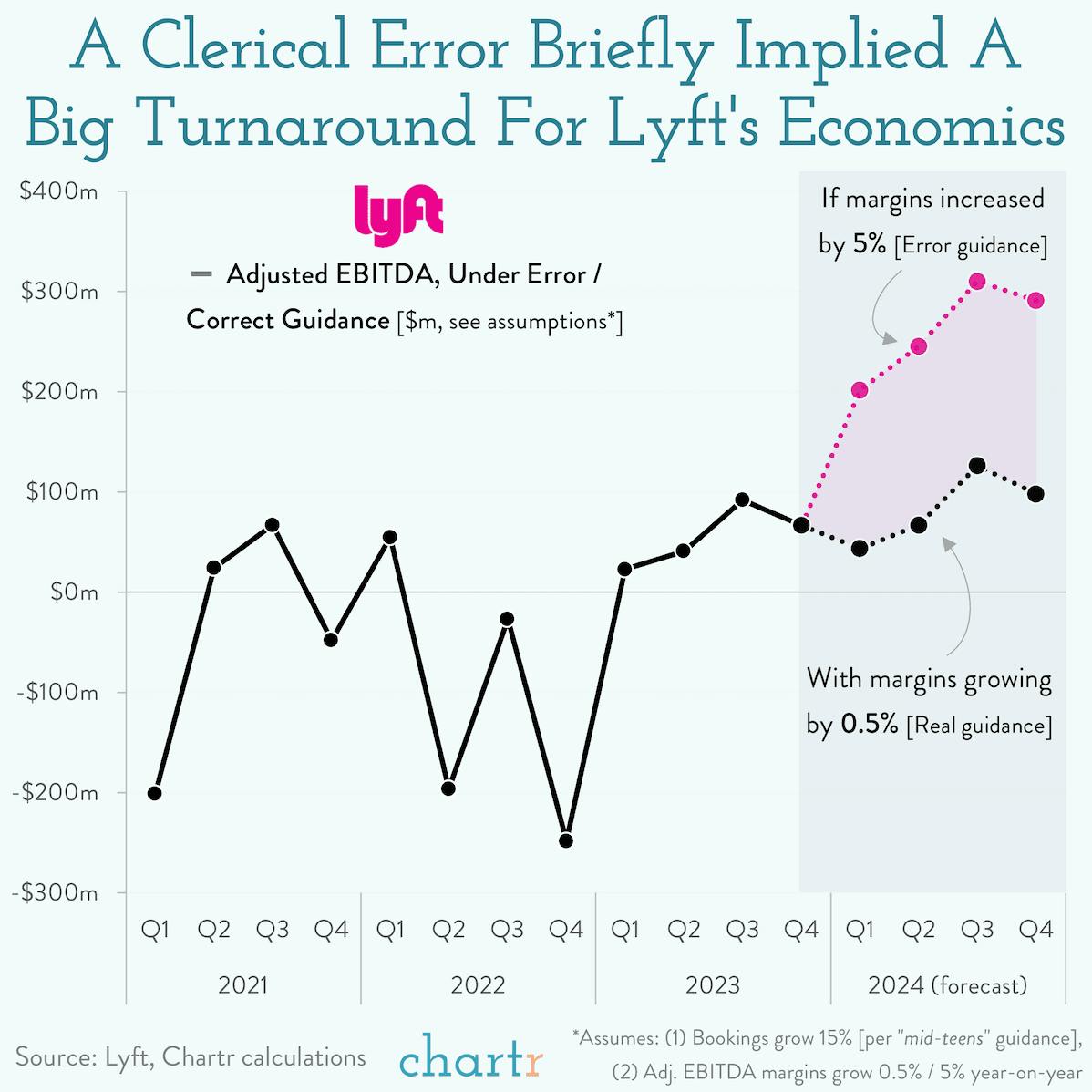

An initial version of the Q4 press release stated that Lyft was set to grow its adjusted EBITDA margin — a closely watched profitability measure — by 5%, suggesting a stunning turnaround in the company’s fortunes. The only problem was that the 5% figure was a typo: the real figure should have been just one-tenth of that (0.5%) — a mistake that implied hundreds of millions of dollars in additional (adjusted) profits for the coming year.

Within the hour, Lyft execs explained the more measured expectations to analysts on an earnings call, with the company subsequently issuing a corrected press release. Although Lyft has since pared its gains, at the time of writing the stock is still up 21% on the day. Indeed, the error overshadows what was otherwise a solid update from Lyft following a difficult year.

Last April, Lyft laid off more than 1,000 employees — one of multiple measures implemented to cut costs as the company bids to join larger rival Uber in becoming consistently profitable. Like so many of its peers, Lyft also has ongoing battles with its drivers, with more than 100,000 Uber, Lyft, and Deliveroo workers set to strike today over disputes regarding pay and working conditions.