Trump doubles down on crypto with launch of Truth.Fi

Trump Media announced the launch of its financial services project, sending the stock soaring.

Today, Trump Media — the parent company of Truth Social — announced the launch of the financial services and FinTech brand Truth.Fi, which will focus on Bitcoin and other cryptocurrencies, as well as “customized” ETFs and separately managed accounts.

Investors loved the news, and Trump Media & Technology Group stock shot up nearly 17% in premarket trading and is up 6.6% as of 10:55 a.m. ET.

The company’s board approved “up to $250 million, to be custodied by Charles Schwab,” according to the press release. CEO and Chairman Devin Nunes said:

“Developing American First investment vehicles is another step toward our goal of creating a robust ecosystem through which American patriots can protect themselves from the ever-present threat of cancellation, censorship, debanking, and privacy violations committed by Big Tech and woke corporations.”

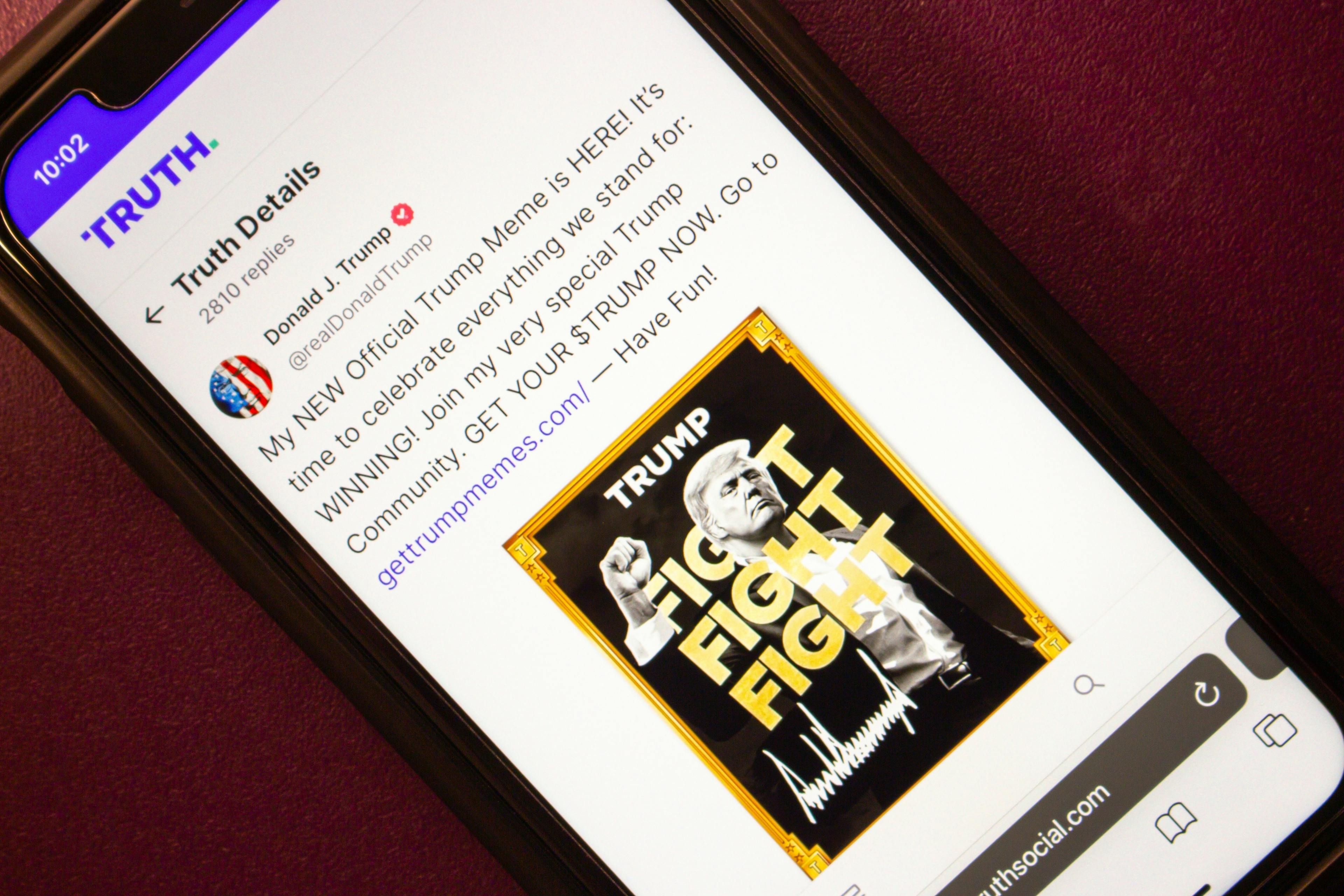

President Trump is doubling down on his crypto endeavors despite what some perceive as a potential conflict of interest. This latest venture follows the launch (just before the inauguration) of crypto tokens trump and $MELANIA.

Last week, a group of senators, including Sen. Elizabeth Warren, wrote a letter to Congress about their concerns around these coins, “including the threats from consumer ripoffs, corruption, and foreign influence, and President Trump’s conflicts of interest,” a statement read.

Crypto Twitter seems mostly bullish on this latest announcement.

Sid Powell, CEO and cofounder of Maple, told Sherwood News that this shows that Trump’s inner circle “is serious about crypto” and that the move is positive for the industry.

“It benefits the sector by bringing it more into the mainstream and shows that companies are increasingly considering holding crypto assets on their balance sheets,” Powell said. “It reinforces the narrative that it is strategically important for the US to win in this sector."

Some experts have had more muted reactions, noting that this underscores both the growing importance of digital assets and the dangers of having high-profile endorsements.

“While it is a great idea that major political figures are bringing the crypto space into the mainstream, it also brings transparency issues, regulatory risks, and potential market instability,” Patrick Gruhn, former head of (now defunct) FTX Europe and founder of Perpetuals.com, told Sherwood.

According to Gruhn, while market sentiment is always very sensitive to high-profile endorsements, trust, security, and sensible regulation are essential for long-term success.

“The future of crypto should be about technological advancement and financial democratization,” Gruhn said, “not the temporary high hype and speculation can bring.”

Yaël Bizouati-Kennedy is a financial journalist who’s written for Dow Jones, The Financial Times Group, and Business Insider