Consultants are making millions from the fierce competition to get into elite colleges

Applying to college is a level playing field... if your parents have $200,000 to spend on a consultant

For a 29 year-old, Jamie Beaton is a man of many hats: a Rhodes scholar, a graduate with six degrees from elite colleges, and a millionaire entrepreneur of a college consulting company that is attracting attention from eager parents and investors alike.

A great article in The Wall Street Journal outlines how Beaton’s clientele pays his company tens of thousands of dollars, or even as much as $200,000, for a program that can offer everything from tutoring for exams to advice for getting stellar teacher recommendations. All with one goal in mind: get kids into elite schools. And, so far, it’s working, with clients of “Crimson Education” accounting for nearly 2% of the students accepted to the undergraduate class of 2028 at elite schools like Harvard, Brown, and Columbia.

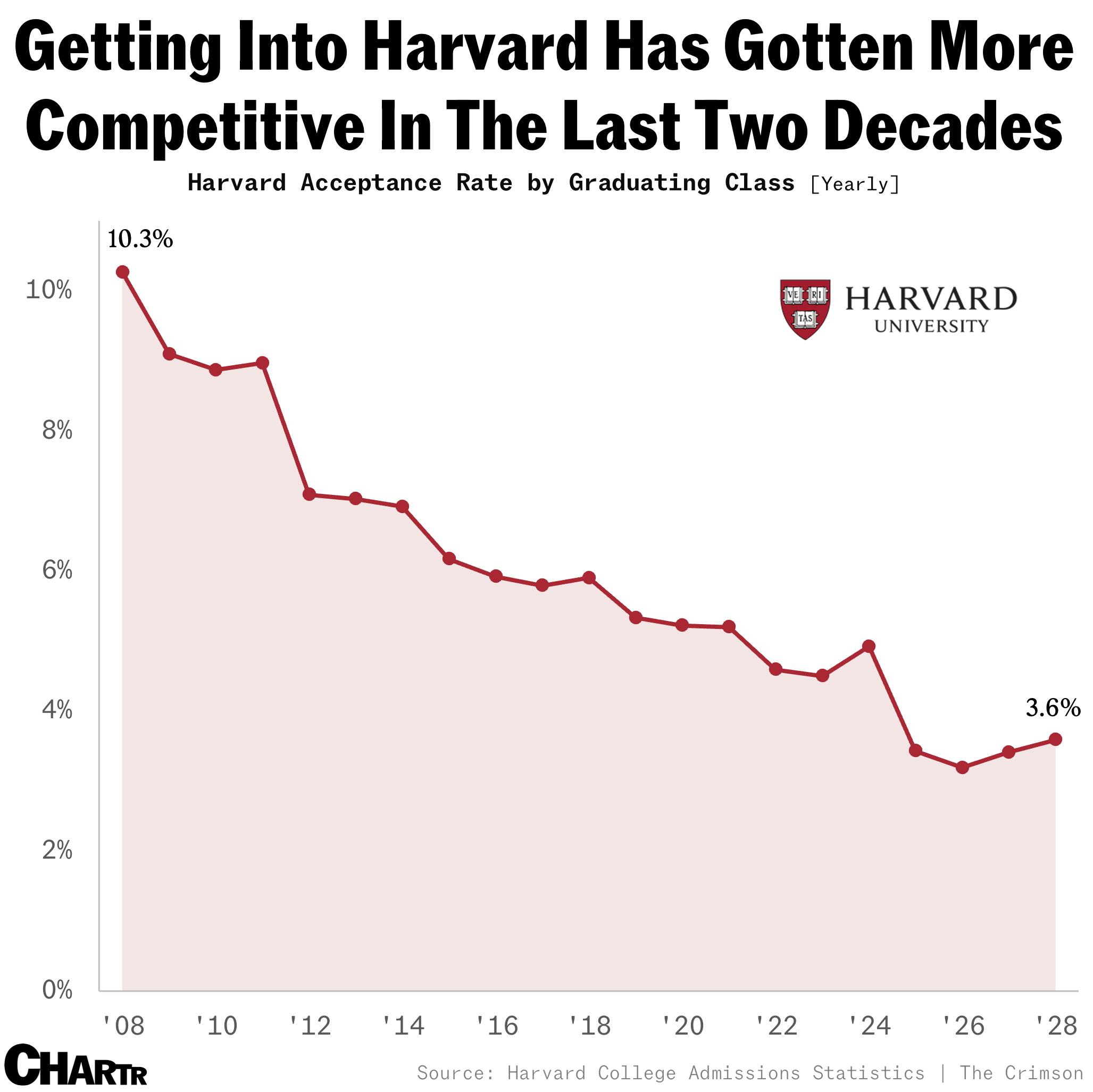

Crimson is part of the college consulting market that’s now estimated to be worth ~$2.9 billion as competition for top-tier universities has intensified, according to market research firm IBISWorld. Indeed, admissions rates for top universities like Harvard have plummeted since 2006, falling from around 10% for the class of 2008 to 3.6% for the most recent 2028 batch.

Experts warn that students — or, more accurately, their parents — continue to be drawn to services like Crimson to navigate the competitive and confusing admissions process in the US primarily because they have limited understanding of the black box of admissions. The college counseling world that lives off the complex process is also bound by few regulations, as recently highlighted by the celebrity-fueled Varsity Blues college admissions cheating scheme headed by Rick Singer.

Last year, Harvard’s student newspaper The Harvard Crimson reported that 26% of its incoming freshmen worked with a private admissions counselor. This share rose to 48% for freshmen from families with incomes over $500,000. Even institutional investors have taken note — after launching in 2013, the company is now valued at more than $550 million, winning investment from VC giant Tiger Management.