For much of this year headlines (including our own) have been devoted to the rise of Nvidia, and rightly so: its valuation is mind-boggling and it has almost single-handedly driven 2024’s “AI theme”.

But, the rest of big tech has also been rising. Indeed, even Apple is now enjoying the “announce an AI product and watch your stock price go up” phenomenon, with its shares up some 14% in the last month. So, how much has big tech gained in 2024?

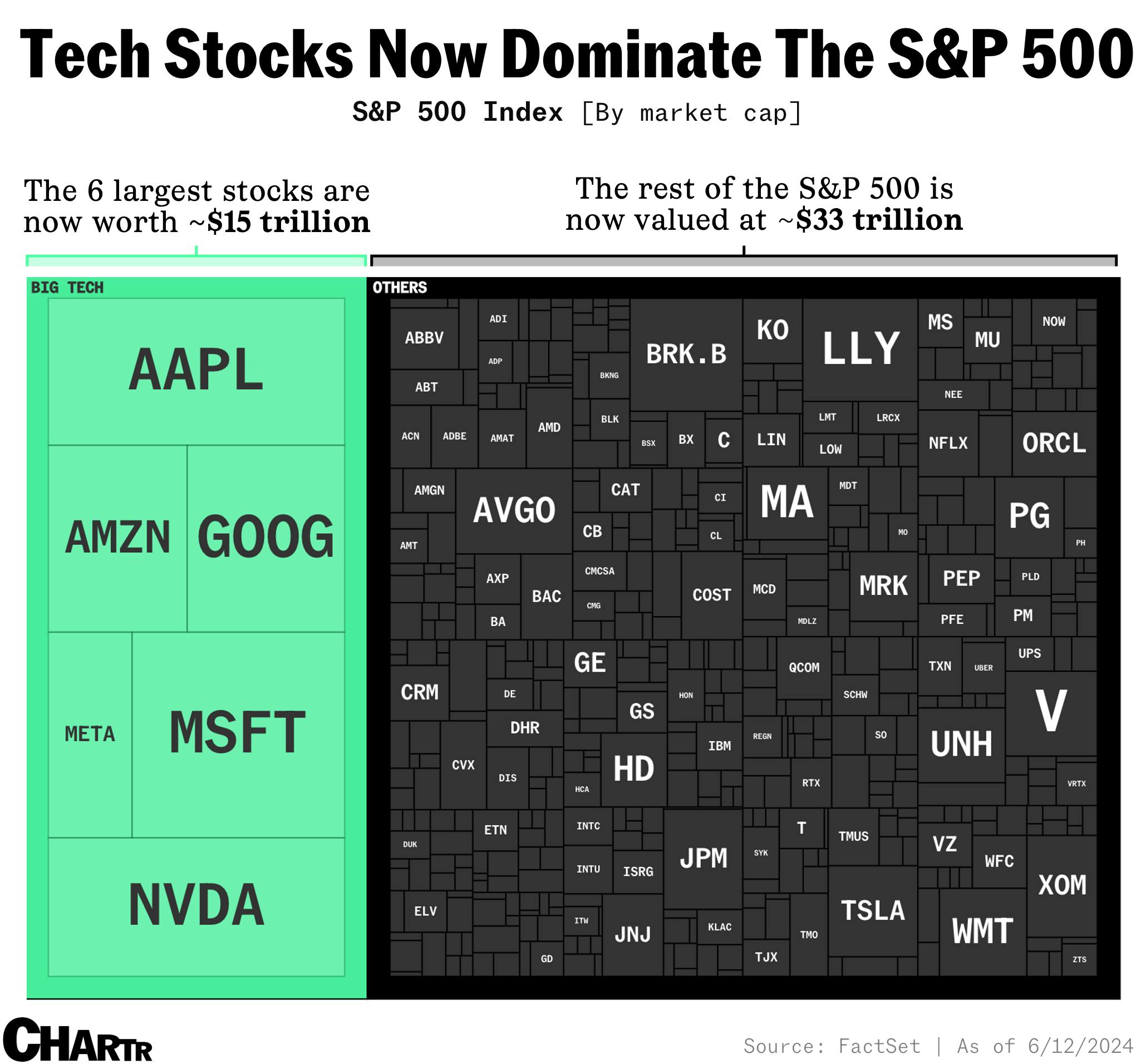

As of yesterday’s close (June 12th), just 6 stocks have added an eye-watering $3.8 trillion in market capitalization. The rest of the S&P 500, the flagship index of America’s biggest public companies, have collectively added just $1.78 trillion. Nvidia alone has gained more than that ($1.86T).

This is pretty remarkable. Just a few years ago, we would often make charts when certain companies crossed the $1T or $2T mark — milestones that once seemed unfathomable, but are now commonplace —as big tech increasingly dominates the largest stock market indices in America.

Amazon is worth nearly 4 Walmarts. Microsoft is worth 59 General Motors. Nvidia is worth 16 McDonald’s. These comparisons are mostly meaningless, but there’s very few companies big enough to make worthwhile observations. In fact, you have to start zooming out to find economic entities of an equivalent size: just 3 of those big tech stocks — Nvidia, Microsoft, and Apple — are bigger than the entire Chinese stock market. The whole thing.

Does this matter?

Yes. Apart from making a lot of big tech employees and shareholders very rich, the rise of big tech is fundamentally altering the world of investing. Research analysts at Morgan Stanley estimate that stock market concentration is near the highest it’s ever been, although there is precedent for similar levels of concentration if you trace the data back to the 1960s (or beyond). Increasingly, what happens to big tech is what happens to the market.