Some of the craziest charts in market history all have one thing in common: Nvidia

In just two years, Nvidia shares have created more than $2.5 trillion in market value.

Some market phenomena are hard to put into words. This is especially true in Nvidia’s case, where it’s worth letting the charts do the talking.

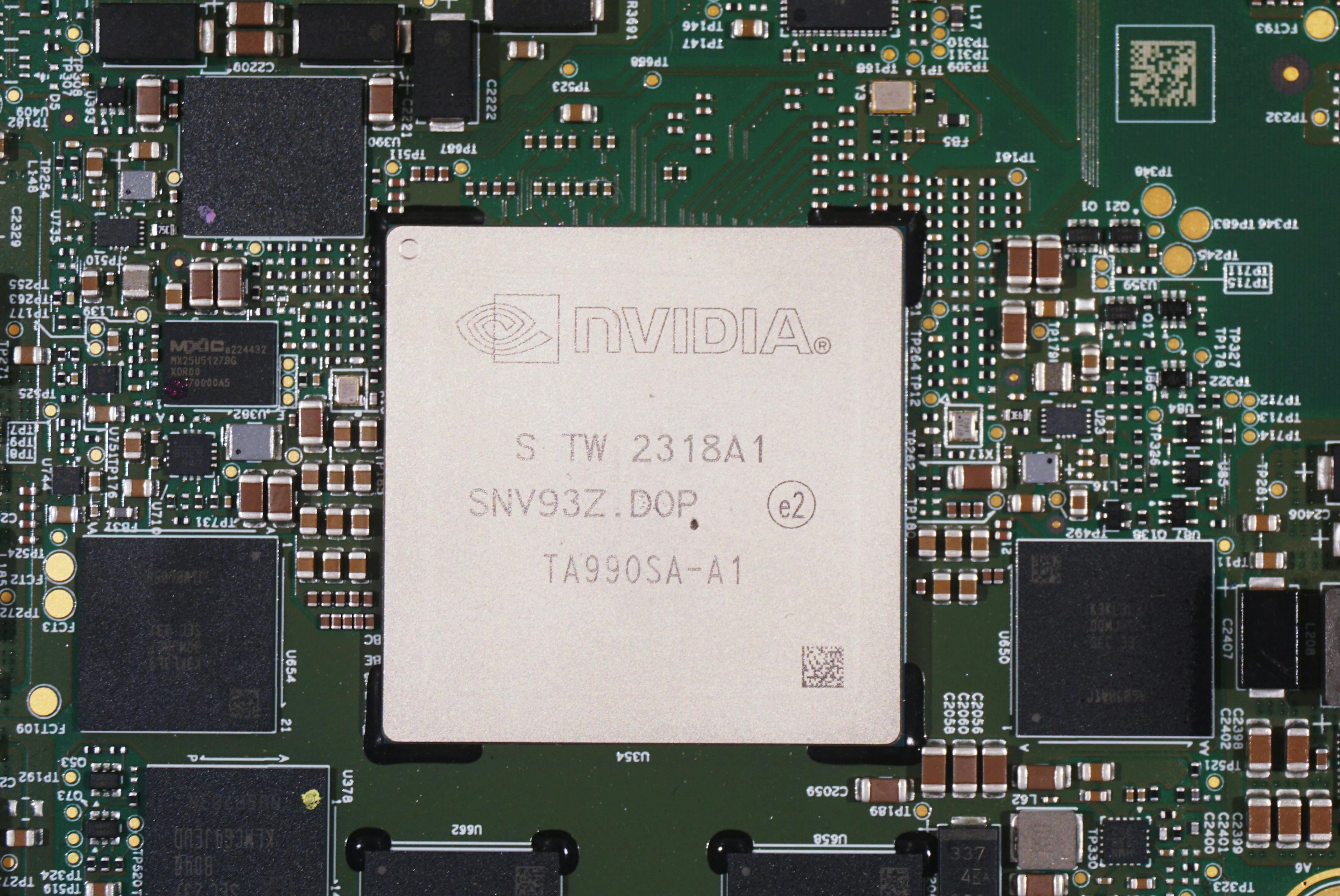

Both Wall Street traders and retail investors who have ridden this stock to remarkable heights will be tuning in after the close of trading on Wednesday, when the chipmaker at the heart of the generative AI boom is set to release its latest report on sales and profits.

Expectations are big, with analysts expecting the angle of incline on Nvidia’s sales to get even steeper, with fiscal second quarter sales to more than double last year’s level for the second straight year, climbing to nearly $29 billion.

Profits, are likewise expected to double, with analysts expecting a 143% jump to more than $15 billion. Some bullish observers think they could rise as high as $16.2 billion in the fiscal second quarter.

The market has taken those numbers and projected them ad infinitum, which is why Nvidia’s stock price has become, over the last couple years, one of the truly remarkable stories in stock market history.

In just two years, Nvidia shares have created more than $2.5 trillion in market value, transforming itself into one of the largest companies in the world. Microsoft and Apple, its two rivals in terms of market heft, spent decades bulking up to that level.

In fact, Nvidia’s stock market capitalization alone is worth more than the entirety of the German stock market, and roughly rivals the value of the Paris Bourse.

Academics who study the history of the stock market say such periods of remarkable outperformance simply cannot last. On the other hand, it’s tough to say when Nvidia’s run will end. So we, like everyone else, will be tuning in for the numbers on Wednesday.