Most companies aren’t talking about AI

AI has been the buzziest of buzzwords for years. A minority of America’s most notable companies are actually talking about it.

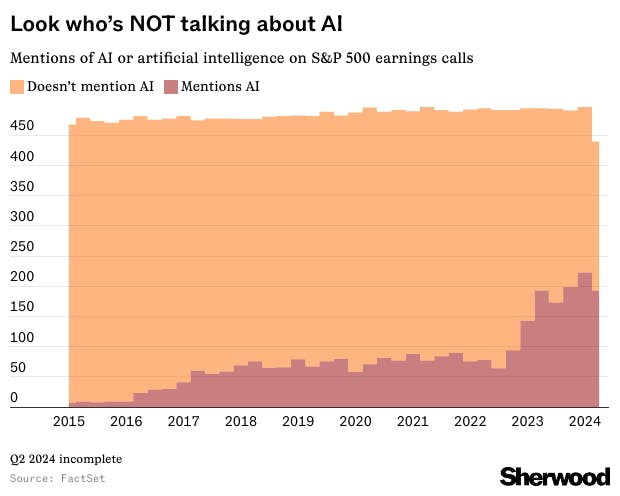

Given the fever pitch at which everyone and their grandpa is talking about AI — not to mention spending money on it — it might surprise you to know the majority of big companies are mum on the subject.

So far this quarter, 44% of S&P 500 companies that have had earnings calls have mentioned “AI” or “artificial intelligence,” while 56% have not. That ratio has been steadily shifting in recent years as companies try to use the technology to save money and boost profits, but the majority of these companies have still yet to embrace AI.

Some of the companies and their industries are pretty obvious and it would probably be a stretch for them to try and pounce on the AI boom. For example, construction materials company Vulcan Materials, which sells crushed stone, sand, gravel and asphalt, has never mentioned AI on a call. Neither have beer maker Molson Coors or energy drink producer Monster Beverage.

Even for a company with a tech bent like Disney, the topic has rarely come up. Last year, an analyst asked CEO Bob Iger about how AI could impact Disney’s business.

“I'm looking forward to a time where maybe AI does earnings calls for me,” Iger joked.

“It's pretty clear that AI developments represent some pretty interesting opportunities for us and some substantial benefits. In fact we're already starting to use AI to create some efficiencies, and ultimately, to better serve consumers,” he said. “On the other hand, I think that there's a lot we're going to have to contend with that will be quite disruptive and quite challenging. Getting more specific is not something I really am prepared to do right now.”

Hilton Worldwide CEO Christopher Nassetta uttered the letters AI once, back in 2018, when the definition of AI was very different than it is now.

Nassetta did talk about it when asked at Skift’s Global Forum last year about genAI.

“Listen, we've been using AI for – in one form or another — for many years and ChatGPT, generative AI is obviously the next step in the evolution,” he said. “When we wake up in 10 or 20 years, it'll be revolutionary in a whole bunch of different ways. But I think it's going to take time, and my personal experience with it so far and our teams' experience with it is, we have a long way to go before it's in that form super productive. But AI has tremendous application already. Not ChatGPT directly, but AI. And we're already, as I said, using it in really powerful ways.”

Indeed, the pivot to AI will likely take longer than many company leaders hope, and returns on investment might not come soon enough for investors wondering what all this AI spending will amount to.

But perhaps, as they say, talk is cheap. While John Deere hasn’t mentioned AI on recent earnings calls, it’s already been using AI for autonomous tractors and to spray herbicide. It discussed AI on earnings calls a few years back, and now has moved on to action.